Page 5 - FSUOGM Week 30 2022

P. 5

FSUOGM COMMENTARY FSUOGM

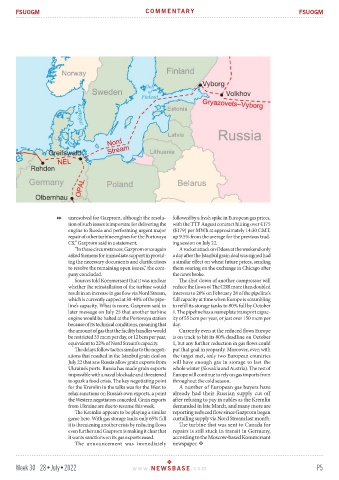

unresolved for Gazprom, although the resolu- followed by a fresh spike in European gas prices,

tion of such issues is important for delivering the with the TTF August contract hitting over €175

engine to Russia and performing urgent major ($179) per MWh at approximately 14:30 GMT,

repair of other turbine engines for the Portovaya up 9.5% from the average for the previous trad-

CS,” Gazprom said in a statement. ing session on July 22.

“In these circumstances, Gazprom once again A rocket attack on Odesa at the weekend only

asked Siemens for immediate support in provid- a day after the Istanbul grain deal was signed had

ing the necessary documents and clarifications a similar effect on wheat future prices, sending

to resolve the remaining open issues,” the com- them soaring on the exchange in Chicago after

pany concluded. the news broke.

Sources told Kommersant that it was unclear The shut down of another compressor will

whether the reinstallation of the turbine would reduce the flows ot The CBR more than doubled

result in an increase in gas flow via Nord Stream, interests to 20% on February 28 of the pipeline’s

which is currently capped at 30-40% of the pipe- full capacity at time when Europe is scrambling

line’s capacity. What is more, Gazprom said in to refill its storage tanks to 80% full by October

later message on July 25 that another turbine 1. The pipeline has a nameplate transport capac-

engine would be halted at the Portovaya station ity of 55 bcm per year, or just over 150 mcm per

because of its technical conditions, meaning that day.

the amount of gas that the facility handles would Currently even at the reduced flows Europe

be restricted 33 mcm per day, or 12 bcm per year, is on track to hit its 80% deadline on October

equivalent to 22% of Nord Stream’s capacity. 1, but any further reduction in gas flows could

The delays follow tactics similar to the negoti- put that goal in jeopardy. Moreover, even with

ations that resulted in the Istanbul grain deal on the target met, only two European countries

July 22 that saw Russia allow grain exports from will have enough gas in storage to last the

Ukraine’s ports. Russia has made grain exports whole winter (Slovakia and Austria). The rest of

impossible with a naval blockade and threatened Europe will continue to rely on gas imports from

to spark a food crisis. The key negotiating point throughout the cold season.

for the Kremlin in the talks was for the West to A number of European gas buyers have

relax sanctions on Russia’s own exports, a point already had their Russian supply cut off

the Western negotiators conceded. Grain exports after refusing to pay in rubles as the Kremlin

from Ukraine are due to resume this week. demanded in late March, and many more are

The Kremlin appears to be playing a similar reporting reduced flow since Gazprom began

game here. With gas storage tanks only 65% full curtailing supply via Nord Stream last month.

it is threatening another crisis by reducing flows The turbine that was sent to Canada for

even further and Gazprom is making it clear that repairs is still stuck in transit in Germany,

it wants sanctions on its gas exports eased. according to the Moscow-based Kommersant

The announcement was immediately newspaper.

Week 30 28•July•2022 www. NEWSBASE .com P5