Page 5 - MEOG Week 25 2022

P. 5

MEOG COMMENTARY MEOG

Presumably this comment was a reference to loan to support its oil and gas expansion plans,

MSC, but no clarification has been provided following an agreement with Tokyo for Nippon

– KPC has previously set 2025 as the date for Export and Investment Insurance (NEXI) to

capacity reaching this level. provide insurance for the finance.

Even more curious were comments carried Al-Fares said that the banks involved in the

by Bloomberg that suggested Kuwait was now discussions include HSBC and JPMorgan.

targeting an MSC of 4mn bpd by 2025, a highly “It was found that there is a need to invest

ambitious fast-track target dates set by KPC and large amounts of money in order for the corpo-

the Ministry of Oil (MoO) October last year – ration to implement (its five-year) strategy and

3.5mn bpd by 2025 and 4mn bpd by 2035, five to maintain and develop production levels,” he

years earlier than previous guidance. added.

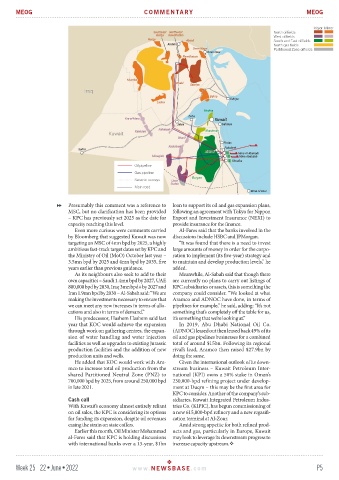

As its neighbours also seek to add to their Meanwhile, Al-Sabah said that though there

own capacities – Saudi 1.4mn bpd by 2027, UAE are currently no plans to carry out listings of

800,000 bpd by 2030, Iraq 3mn bpd+ by 2027 and KPC subsidiaries or assets, this is something the

Iran 1.9mn bpd by 2030 – Al-Sabah said: “We are company could consider. “We looked at what

making the investments necessary to ensure that Aramco and ADNOC have done, in terms of

we can meet any new increases in terms of allo- pipelines for example,” he said, adding: “It’s not

cations and also in terms of demand.” something that’s completely off the table for us,

His predecessor, Hashem Hashem said last it’s something that we’re looking at.”

year that KOC would achieve the expansion In 2019, Abu Dhabi National Oil Co.

through work on gathering centres, the expan- (ADNOC) leased out then leased back 49% of its

sion of water handling and water injection oil and gas pipelines businesses for a combined

facilities as well as upgrades to existing Jurassic total of around $15bn. Following its regional

production facilities and the addition of new rival’s lead, Aramco then raised $27.9bn by

production units and wells. doing the same.

He added that KOC would work with Ara- Given the international outlook of its down-

mco to increase total oil production from the stream business – Kuwait Petroleum Inter-

shared Partitioned Neutral Zone (PNZ) to national (KPI) owns a 50% stake in Oman’s

700,000 bpd by 2025, from around 250,000 bpd 230,000-bpd refining project under develop-

in late 2021. ment at Duqm – this may be the first area for

KPC to consider. Another of the company’s sub-

Cash call sidiaries, Kuwait Integrated Petroleum Indus-

With Kuwait’s economy almost entirely reliant tries Co. (KIPIC), has begun commissioning of

on oil sales, the KPC is considering its options a new 615,000-bpd refinery and a new regasifi-

for funding its expansion, despite oil revenues cation terminal at Al-Zour.

easing the strain on state coffers. Amid strong appetite for both refined prod-

Earlier this month, Oil Minister Mohammad ucts and gas, particularly in Europe, Kuwait

al-Fares said that KPC is holding discussions may look to leverage its downstream progress to

with international banks over a 13-year, $1bn increase capacity upstream.

Week 25 22•June•2022 www. NEWSBASE .com P5