Page 5 - EurOil Week 49 2021

P. 5

EurOil COMMENTARY EurOil

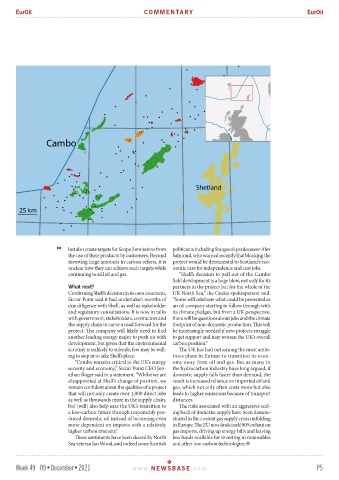

but also create targets for Scope 3 emissions from politicians including Sturgeon’s predecessor Alex

the use of their products by customers. Beyond Salmond, who warned recently that blocking the

investing huge amounts in carbon offsets, it is project would be detrimental to Scotland’s eco-

unclear how they can achieve such targets while nomic case for independence and cost jobs.

continuing to sell oil and gas. “Shell’s decision to pull out of the Cambo

field development is a huge blow, not only for its

What next? partners in the project but for the whole of the

Confirming Shell’s decision in its own statement, UK North Sea,” the Gneiss spokesperson said.

Siccar Point said it had undertaken months of “Some will celebrate what could be presented as

due diligence with Shell, as well as stakeholder an oil company starting to follow through with

and regulatory consultations. It is now in talks its climate pledges, but from a UK perspective,

with government, stakeholders, contractors and there will be questions about jobs and the climate

the supply chain to carve a road forward for the footprint of non-domestic production. This will

project. The company will likely need to find be increasingly needed if new projects struggle

another leading energy major to push on with to get support and may worsen the UK’s overall

development, but given that the environmental carbon position.”

scrutiny is unlikely to subside, few may be will- The UK has laid out among the most ambi-

ing to step in to take Shell’s place. tious plans in Europe to transition its econ-

“Cambo remains critical to the UK’s energy omy away from oil and gas. But as many in

security and economy,” Siccar Point CEO Jon- the hydrocarbon industry have long argued, if

athan Roger said in a statement. “Whilst we are domestic supply falls faster than demand, the

disappointed at Shell’s change of position, we result is increased reliance on imported oil and

remain confident about the qualities of a project gas, which not only often costs more but also

that will not only create over 1,000 direct jobs leads to higher emissions because of transport

as well as thousands more in the supply chain, distances.

but [will] also help ease the UK’s transition to The risks associated with an aggressive scal-

a low-carbon future through responsibly pro- ing back of domestic supply have been demon-

duced domestic oil instead of becoming even strated in the current gas supply crisis unfolding

more dependent on imports with a relatively in Europe. The EU now finds itself 90% reliant on

higher carbon intensity.” gas imports, driving up energy bills and leaving

These sentiments have been shared by North less funds available for investing in renewables

Sea veteran Ian Wood, and indeed some Scottish and other low-carbon technologies.

Week 49 09•December•2021 www. NEWSBASE .com P5