Page 8 - AfrOil Week 35 2022

P. 8

AfrOil INVESTMENT AfrOil

FAR indicated in the statement, though, that the The Gambia assets and the positive discussions

financial issues that led it to consider a farm-out with the government of The Gambia on the

had changed somewhat. terms for the first extension exploration period

Specifically, it explained that it had success- will provide FAR options to utilise its valuable

fully negotiated with the government of The exploration data to maximise value from the

Gambia, as part of the acquisition deal, for the asset,” he said. “These developments have min-

removal of the requirement for drilling an addi- imal impact on FAR’s forward budget while

tional exploration well during the next two-year significantly improving the chance of securing

licence term for the blocks, which is due to begin new investment. FAR remains committed to

on October 1, 2022. generating real value for our shareholders, and

This development “results in a significant we see this transaction as a part of that overar-

reduction in expenditure and allows for a ching strategy.”

detailed geoscience review incorporating the FAR has been working at Blocks A2 and A5

results of the recent Samo-1 and Bambo-1 wells since 2017.

to ensure future exploration wells are located

optimally,” it said.

As such, it said, FAR is now in a position to

proceed with a farm-out on different terms.

With complete ownership of the assets, it can

seek partners with the financial and technical

resources to carry out the drilling programme

and has set up a data room to make information

available to potential investors.

“FAR expects new partners to fund the costs

of the work programme,” the Australian com-

pany added. “Subject to the satisfaction of cer-

tain conditions, including government approval,

incoming participants in the joint venture may

assume operatorship.”

In the meantime, FAR is continuing to assess

the data collected from the Bambo-1 explora-

tion well, along with an accompanying sidetrack

well Bambo-1ST1, both drilled at Block A2.

Oil shows were detected during the drilling of

both wells, and laboratory work has confirmed

the presence of crude at multiple layers below

S390, the secondary drilling objective. It has

also de-risked the nearby Panthera prospect as a

future drilling target, the statement said.

FAR chairman Patrick O’Connor said he

expected the company to benefit from buying

out its Malaysian partner.

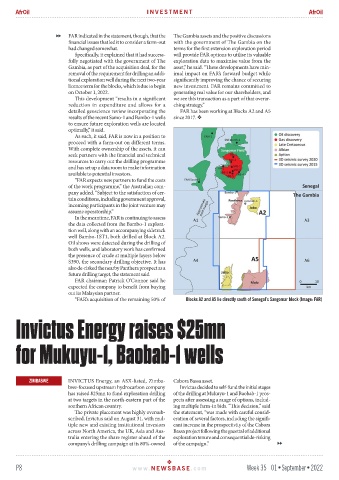

“FAR’s acquisition of the remaining 50% of Blocks A2 and A5 lie directly south of Senegal’s Sangomar block (Image: FAR)

Invictus Energy raises $25mn

for Mukuyu-1, Baobab-1 wells

ZIMBABWE INVICTUS Energy, an ASX-listed, Zimba- Cabora Bassa asset.

bwe-focused upstream hydrocarbon company Invictus decided to self-fund the initial stages

has raised $25mn to fund exploration drilling of the drilling at Mukuyu-1 and Baobab-1 pros-

at two targets in the north-eastern part of the pects after assessing a range of options, includ-

southern African country. ing multiple farm-in bids. “This decision,” said

The private placement was highly oversub- the statement, “was made with careful consid-

scribed, Invictus said on August 31, with mul- eration of several factors, including the signifi-

tiple new and existing institutional investors cant increase in the prospectivity of the Cabora

across North America, the UK, Asia and Aus- Bassa project following the gazettal of additional

tralia entering the share register ahead of the exploration tenure and consequential de-risking

company’s drilling campaign at its 80%-owned of the campaign.”

P8 www. NEWSBASE .com Week 35 01•September•2022