Page 53 - Small Stans and Causcasus Outlook 2022

P. 53

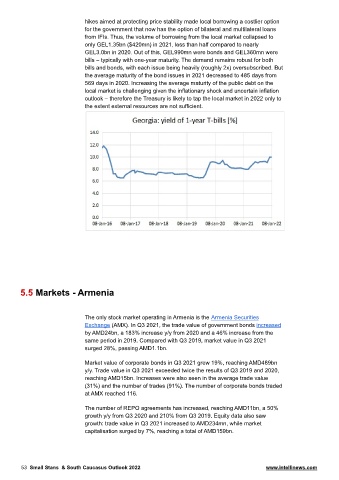

hikes aimed at protecting price stability made local borrowing a costlier option

for the government that now has the option of bilateral and multilateral loans

from IFIs. Thus, the volume of borrowing from the local market collapsed to

only GEL1.35bn ($420mn) in 2021, less than half compared to nearly

GEL3.0bn in 2020. Out of this, GEL990mn were bonds and GEL360mn were

bills – typically with one-year maturity. The demand remains robust for both

bills and bonds, with each issue being heavily (roughly 2x) oversubscribed. But

the average maturity of the bond issues in 2021 decreased to 485 days from

569 days in 2020. Increasing the average maturity of the public debt on the

local market is challenging given the inflationary shock and uncertain inflation

outlook – therefore the Treasury is likely to tap the local market in 2022 only to

the extent external resources are not sufficient.

5.5 Markets - Armenia

The only stock market operating in Armenia is the Armenia Securities

Exchange (AMX). In Q3 2021, the trade value of government bonds increased

by AMD24bn, a 183% increase y/y from 2020 and a 46% increase from the

same period in 2019. Compared with Q3 2019, market value in Q3 2021

surged 28%, passing AMD1.1bn.

Market value of corporate bonds in Q3 2021 grew 19%, reaching AMD489bn

y/y. Trade value in Q3 2021 exceeded twice the results of Q3 2019 and 2020,

reaching AMD15bn. Increases were also seen in the average trade value

(31%) and the number of trades (91%). The number of corporate bonds traded

at AMX reached 116.

The number of REPO agreements has increased, reaching AMD11bn, a 50%

growth y/y from Q3 2020 and 210% from Q3 2019. Equity data also saw

growth: trade value in Q3 2021 increased to AMD234mn, while market

capitalisation surged by 7%, reaching a total of AMD159bn.

53 Small Stans & South Caucasus Outlook 2022 www.intellinews.com