Page 11 - MEOG Week 01 2021

P. 11

MEOG PIPELINES & TRANSPORT MEOG

much higher prices compared to European nat- annual 31.5bcm capacity. Russia is also work-

ural gas importers. ing on building up its Nord Stream pipelines to

Russia has already provided a 40% discount Europe to an overall capacity of 110bcm. Nord

for Bulgaria along with some “substantial” dis- Stream II will have a 55bcm capacity, but its con-

counts to some other European countries, Yigit struction has been held up by US sanctions. It

also observed. will complement the already operational 55bcm

Meanwhile, the natural gas competition Nord Stream I.

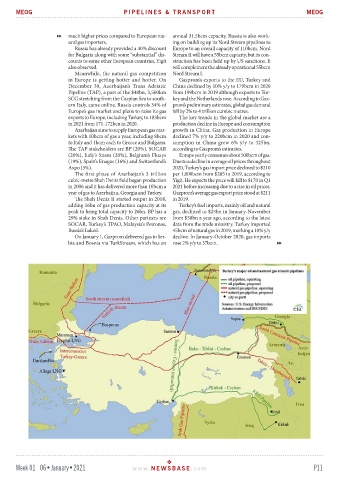

in Europe is getting hotter and hotter. On Gazprom’s exports to the EU, Turkey and

December 30, Azerbaijan’s Trans Adriatic China declined by 10% y/y to 179bcm in 2020

Pipeline (TAP), a part of the $40bn, 3,500km from 199bcm in 2019 although exports to Tur-

SCG stretching from the Caspian Sea to south- key and the Netherlands rose. According to Gaz-

ern Italy, came online. Russia controls 34% of prom’s preliminary estimates, global gas demand

Europe’s gas market and plans to raise its gas fell by 2% to 4 trillion cumbic metres.

exports to Europe, including Turkey, to 183bcm The key trends in the global market are a

in 2021 from 171-172bcn in 2020. production decline in Europe and consumption

Azerbaijan aims to supply European gas mar- growth in China. Gas production in Europe

kets with 10bcm of gas a year, including 8bcm declined 7% y/y to 220bcm in 2020 and con-

to Italy and 1bcm each to Greece and Bulgaria. sumption in China grew 6% y/y to 325bn,

The TAP stakeholders are BP (20%), SOCAR according to Gazprom’s estimates.

(20%), Italy’s Snam (20%), Belgium’s Fluxys Europe yearly consumes about 500bcm of gas.

(19%), Spain’s Enagas (16%) and Switzerland’s Due to a decline in average oil prices throughout

Axpo (5%). 2020, Turkey’s gas import price declined to $210

The first phase of Azerbaijan’s 3 trillion per 1,000bcm from $285 in 2019, according to

cubic-metre Shah Deniz field began production Yigit. He expects the price will fall to $170 in Q1

in 2006 and it has delivered more than 10bcm a 2021 before increasing due to a rise in oil prices.

year of gas to Azerbaijan, Georgia and Turkey. Gazprom’s average gas export price stood at $211

The Shah Deniz II started output in 2018, in 2019.

adding 16bn of gas production capacity at its Turkey’s fuel imports, mainly oil and natural

peak to bring total capacity to 26bn. BP has a gas, declined to $25bn in January-November

29% stake in Shah Deniz. Other partners are from $38bn a year ago, according to the latest

SOCAR, Turkey’s TPAO, Malaysia’s Petronas, data from the trade ministry. Turkey imported

Russia’s Lukoil. 45bcm of natural gas in 2019, marking a 10% y/y

On January 1, Gazprom delivered gas to Ser- decline. In January-October 2020, gas imports

bia and Bosnia via TurkStream, which has an rose 2% y/y to 37bcm.

Week 01 06•January•2021 www. NEWSBASE .com P11