Page 5 - DMEA Week 11 2022

P. 5

DMEA COMMENTARY DMEA

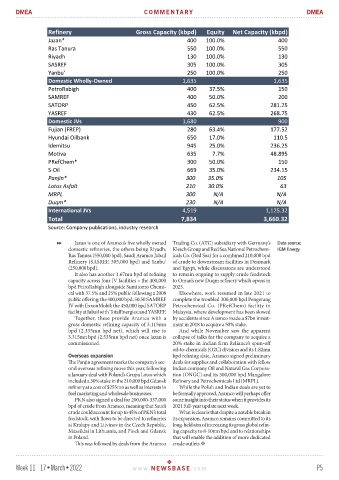

Refinery Gross Capacity (kbpd) Equity Net Capacity (kbpd)

Jazan* 400 100.0% 400

Ras Tanura 550 100.0% 550

Riyadh 130 100.0% 130

SASREF 305 100.0% 305

Yanbu' 250 100.0% 250

Domestic Wholly-Owned 1,635 1,635

PetroRabigh 400 37.5% 150

SAMREF 400 50.0% 200

SATORP 450 62.5% 281.25

YASREF 430 62.5% 268.75

Domestic JVs 1,680 900

Fujian (FREP) 280 63.4% 177.52

Hyundai Oilbank 650 17.0% 110.5

Idemitsu 945 25.0% 236.25

Motiva 635 7.7% 48.895

PRefChem* 300 50.0% 150

S-Oil 669 35.0% 234.15

Panjin* 300 35.0% 105

Lotos Asfalt 210 30.0% 63

MRPL 300 N/A N/A

Duqm* 230 N/A N/A

International JVs 4,519 1,125.32

Total 7,834 3,660.32

Source: Company publications, industry research

Jazan is one of Aramco’s five wholly owned Trading Co. (ATC) subsidiary with Germany’s Data source:

domestic refineries, the others being Riyadh, Klesch Group and Red Sea National Petrochem- IGM Energy

Ras Tanura (550,000 bpd), Saudi Aramco Jubail icals Co. (Red Sea) for a combined 210,000 bpd

Refinery (SASREF, 305,000 bpd) and Yanbu’ of crude to downstream facilities in Denmark

(250,000 bpd). and Egypt, while discussions are understood

It also has another 1.67mn bpd of refining to remain ongoing to supply crude feedstock

capacity across four JV facilities – the 400,000 to Oman’s new Duqm refinery which opens in

bpd PetroRabigh alongside Sumitomo Chemi- 2023.

cal with 37.5% and 25% public following a 2008 Elsewhere, work resumed in late 2021 to

public offering; the 400,000 bpd, 50:50 SAMREF complete the troubled 300,000 bpd Pengerang

JV with ExxonMobil; the 450,000 bpd SATORP Petrochemical Co. (PRefChem) facility in

facility at Jubail with TotalEnergies; and YASREF. Malaysia, where development has been slowed

Together, these provide Aramco with a by accidents since Aramco made a $7bn invest-

gross domestic refining capacity of 3.115mn ment in 2018 to acquire a 50% stake.

bpd (2.335mn bpd net), which will rise to And while November saw the apparent

3.315mn bpd (2.535mn bpd net) once Jazan is collapse of talks for the company to acquire a

commissioned. 20% stake in Indian firm Reliance’s spun-off

oil-to-chemicals (O2C) division and its 1.82mn

Overseas expansion bpd refining slate, Aramco signed preliminary

The Panjin agreement marks the company’s sec- deals for supplies and collaboration with fellow

ond overseas refining move this year, following Indian company Oil and Natural Gas Corpora-

a January deal with Poland’s Grupa Lotos which tion (ONGC) and its 300,000 bpd Mangalore

included a 30% stake in the 210,000 bpd Gdansk Refinery and Petrochemicals Ltd (MRPL).

refinery at a cost of $255mn as well as interests in While the Polish and Indian deals are yet to

fuel marketing and wholesale businesses. be formally approved, Aramco will perhaps offer

PKN also signed a deal for 200,000-337,000 some insight into their status when it provides its

bpd of crude from Aramco, meaning that Saudi 2021 full-year update next week.

crude could account for up to 45% of PKN’s total What is clear is that despite a notable break in

feedstock, with flows to be directed to refineries its expansion, Aramco remains committed to its

at Kralupy and Litvinov in the Czech Republic, long-held aim of increasing its gross global refin-

Mazeikiai in Lithuania, and Plock and Gdansk ing capacity to 8-10mn bpd and to relationships

in Poland. that will enable the addition of more dedicated

This was followed by deals from the Aramco crude outlets.

Week 11 17•March•2022 www. NEWSBASE .com P5