Page 10 - AfrOil Week 07 2022

P. 10

AfrOil POLICY AfrOil

Additionally, the Italian energy services contrac- contract under a ruling issued in December

tor reported that it had incurred a fine of around 2020.

€192mn as a result of the guilty verdict. It said it The Algerian court ruling is coming just a few

intended to book those costs on its accounts at short weeks after Saipem’s announcement in late

the end of Fiscal Year 2021 but would not pay January that it had sustained losses equivalent to

the fine immediately, since it intended to file an nearly one third of its total equity in 2021.

appeal with the aim of securing the suspension That news pulled the energy services con-

of the verdict and the fine. (Instead, the funds tractor’s share and bond prices down signifi-

will be set aside in case they are needed later, cantly, and the independent Italian investment

Reuters noted.) bank Equita said in a research note on February

The company went on to say that it had not 15 that the GNL3 Arzew verdict made further

yet been notified of the reasoning underlying losses likely.

the court’s decision. It also stressed that it had “We believe the conviction can expand the

been fully acquitted in the Italian court system of [2021] net operating loss... to €2.3-2.4bn,” the

corruption charges related to the GNL3 Arzew note said.

PROJECTS & COMPANIES

Aramco Trading Co. signs supply and

offtake deal for Egypt’s Red Sea project

EGYPT SAUDI Arabia’s Aramco Trading Co. (ATC) this Petroleum & Mineral Resources (MOPMR) in

week signed a non-binding deal to supply crude early 2021, the complex will process just over

oil to a new refining and petrochemicals facil- 80,000 barrels per day (bpd) of crude to produce

ity in Egypt with a provision for the offtake of 2.7mn tonnes per year (tpy) of petrochemicals

refined products and petrochemicals. and 1.2mn tpy of petroleum products and is

The local Red Sea National Petrochemicals scheduled to be completed by the end of 2024.

Co. (Red Sea) began work on a $7.5bn facility This week’s deal will see ATC supply 100,000

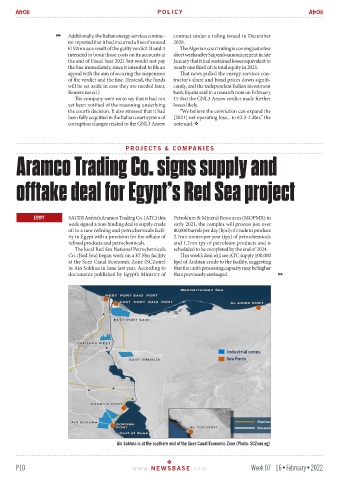

at the Suez Canal Economic Zone (SCZone) bpd of Arabian crude to the facility, suggesting

in Ain Sokhna in June last year. According to that the unit’s processing capacity may be higher

documents published by Egypt’s Ministry of than previously envisaged.

Ain Sokhna is at the southern end of the Suez Canal Economic Zone (Photo: SCZone.eg)

P10 www. NEWSBASE .com Week 07 16•February•2022