Page 15 - AfrOil Week 10 2021

P. 15

AfrOil PROJECTS & COMPANIES AfrOil

Equity in the NLNG consortium is divided investment decision (FID) on the Train 7 project

between state-owned NNPC, with 49%; Royal last year. This initiative envisions the construc-

Dutch Shell (UK/Netherlands), with 25.6%; tion of a seventh production train that can turn

Total (France), with 15%, and Eni (Italy), with out 4.2mn tpy, as well as the debottlenecking of

10.4%. existing trains, which will add another 3.4mn

The consortium’s members made a final tpy of capacity.

DPR authorises installation

of FLNG unit at Yoho oilfield

NIGERIA NIGERIA’S Department of Petroleum for example, were built for Malaysia’s Kanowit

Resources (DPR) has reportedly authorised a project and are slated to remain there.

contractor working for ExxonMobil (US) and The only existing FLNG unit known to be

Nigerian National Petroleum Corp. (NNPC) to available is a smaller vessel – the 500,000 tpy

install a floating LNG (FLNG) unit at the Yoho Tango LNG, which Argentina’s national oil com-

oilfield. pany (NOC) YPF chartered in 2019 for installa-

Templars, the Nigerian legal firm that has tion near Buenos Aires.

been serving as advisor for the FLNG project, YPF declared force majeure on its contract

said earlier this week that DPR had issued a with Exmar, the Belgian company that owns

licence to UTM, the Nigerian firm that has Tango LNG, in 2020, citing fallout from the

agreed to install the vessel for ExxonMobil and coronavirus (COVID-19) pandemic. The ves-

NNPC. UTM intends to provide an FLNG unit sel has been berthed in the Uruguayan port of

capable of turning out 1.2mn tonnes per year Nueva Palmira ever since.

(tpy) of LNG, it noted. ExxonMobil and NNPC began develop-

After installation, the vessel is slated to pro- ment of the Yoho oilfield in 2003. They have

cess up to 176mn cubic feet (4.984mn cubic been re-injecting associated gas back into the

metres) per day of associated gas from the Yoho reservoir in order to maximise yields but are

field. This will allow it to produce one or two now looking to switch course, since the site is

standard-size LNG cargoes each month, Tem- mature. The FLNG project will give the partners

plars said. a means of commercialising the gas while they

According to the law firm, the Nigerian wind down oil extraction.

firm has not yet decided whether to charter an In the meantime, Yoho is still yielding about

existing FLNG vessel or order a newbuild unit 35,000 barrels per day (bpd) of oil. ExxonMo-

for the project. Most existing units have already bil and NNPC are using a floating production,

been assigned to other projects, or were pur- storage and off-loading (FPSO) to develop the

pose-built for them; the PFLNG-1 and-2 vessels, offshore field.

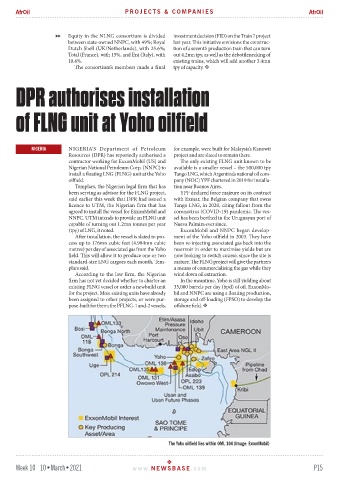

The Yoho oilfield lies within OML 104 (Image: ExxonMobil)

Week 10 10•March•2021 www. NEWSBASE .com P15