Page 8 - AfrOil Week 10 2021

P. 8

AfrOil PIPELINES & TRANSPORT AfrOil

Its progress has been slowed by civil issues and a South Sudan and have arterial branches to Moy-

lack of buy-in from the governments involved. ale from Garissa.

It was further delayed when the Ugandan First oil had been anticipated to flow through

government and the companies developing its the Lokichar-Lamu conduit by late this year/

Lake Albert oilfields elected to export the waxy early 2022 at 60,000-80,000 barrels per day

crude via a heated export pipeline through Tan- (bpd), while Kenya and Ethiopia signed agree-

zania to the port of Tanga. The choice of the East ment for development of a fuel line from Lamu

African Crude Oil Pipeline (EACOP) followed to Addis Ababa.

protracted discussions around it and two pro- There had been talk of building an oil refin-

posed routes through Kenya. ery either at Isiolo in the centre of the country

Tanzania’s President John Magufuli offered or at Lamu. In January 2019, LCDA said that a

sweeteners to sway the parties away from a pro- 125,000 bpd facility would cost $2.8bn; however,

visionally agreed LAPSSET route, including the authorities have since ruled out building a

a 10-year corporate income tax holiday and a new refinery on the grounds that such project

three-year waiver of VAT. Work on that pipeline would be uneconomic at a capacity of less than

is due to kick off this month ahead of completion 400,000 bpd.

in 2024. At any rate, the figures quoted appear ambi-

Further delays came last year when the Kenya tious, with a 60,000 bpd facility being built at

Defence Forces (KDF) demanded that the route Hoima by Uganda’s Lake Albert partners Total,

be altered to avoid encroaching on its lands. Tullow and China National Offshore Oil Corp.

Following a meeting between the KDF and the (CNOOC) anticipated to cost around $4bn.

LAPSSET Corridor Development Authority Kenya has already suffered a significant

(LCDA), the project developers – the Kenyan refining setback in recent years, with the for-

government, London-listed Tullow Oil, France’s mer 35,000 bpd Kenya Petroleum Refineries

Total and independent Africa Oil Corp. – made Ltd (KPRL) facility at Changamwe closing in

a revision to the route. late 2013. The closure followed the withdrawal

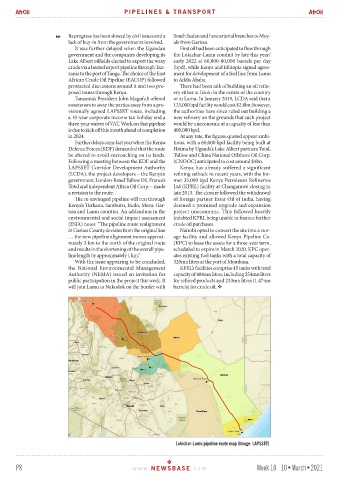

The re-envisaged pipeline will run through of foreign partner Essar Oil of India, having

Kenya’s Turkana, Samburu, Isiolo, Meru, Gar- deemed a promised upgrade and expansion

issa and Lamu counties. An addendum in the project uneconomic. This followed heavily

environmental and social impact assessment indebted KPRL being unable to finance further

(ESIA) notes: “The pipeline route realignment crude oil purchases.

in Garissa County deviates from the original line Nairobi opted to convert the site into a stor-

… the new pipeline alignment moves approxi- age facility and allowed Kenya Pipeline Co.

mately 3 km to the north of the original route (KPC) to lease the assets for a three-year term,

and results in the shortening of the overall pipe- scheduled to expire in March 2020. KPC oper-

line length by approximately 1 km.” ates existing fuel tanks with a total capacity of

With the issue appearing to be concluded, 320mn litres at the port of Mombasa.

the National Environmental Management KPRL’s facilities comprise 45 tanks with total

Authority (NEMA) issued an invitation for capacity of 484mn litres, including 254mn litres

public participation in the project this week. It for refined products and 233mn litres (1.47mn

will join Lamu to Nakodok on the border with barrels) for crude oil.

Lokichar-Lamu pipeline route map (Image: LAPSSET)

P8 www. NEWSBASE .com Week 10 10•March•2021