Page 8 - LatAmOil Week 48 2022

P. 8

LatAmOil GUYANA LatAmOil

BP International will be taking over from a unit operator ExxonMobil (US), BP International

of Aramco, Saudi Arabia’s national oil company will therefore be responsible for marketing

(NOC), which has been serving as the market- about 180,000 bpd next year.

ing agent for the Guyanese government’s share Under its 12-month contract, the BP subsid-

of crude exports in 2022. In this capacity, the iary will be tasked with guiding and supporting

Aramco subsidiary has been handling cargoes Georgetown in all operating and back-office

of Liza, a medium to light sweet grade of crude, tasks related to management of crude sales, both

and Unity Gold, a light sweet grade. It has been in general and with respect to each individual

delivering the oil to market in cargoes of about lifting. It will be responsible for ensuring that

1mn barrels each. the transactions are carried out in a timely and

Stabroek is currently yielding about 360,000 cost-effective manner and for finding new cus-

barrels per day (bpd) of oil, with 140,000 bpd tomers for Guyanese crude oil.

coming from Liza-1 and 220,000 bpd from Liza- Moreover, it will be expected to work closely

2. Since Guyana’s government is entitled to 50% with officials in Georgetown to understand how

of all profit oil extracted from the block under yields from Guyanese crude grades affect sales

the profit-sharing agreement (PSA) signed with prices.

Hess expects ExxonMobil to focus

on Stabroek’s deeper layers in 2023

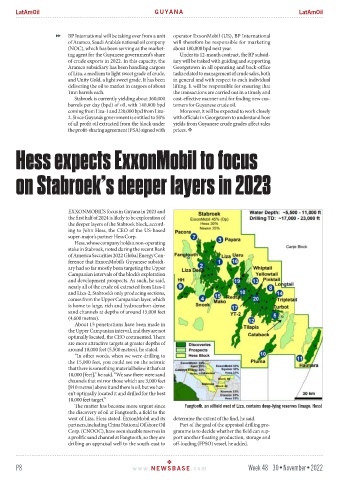

EXXONMOBIL’S focus in Guyana in 2023 and

the first half of 2024 is likely to be exploration of

the deeper layers of the Stabroek block, accord-

ing to John Hess, the CEO of the US-based

super-major’s partner Hess Corp.

Hess, whose company holds a non-operating

stake in Stabroek, noted during the recent Bank

of America Securities 2022 Global Energy Con-

ference that ExxonMobil’s Guyanese subsidi-

ary had so far mostly been targeting the Upper

Campanian intervals of the block’s exploration

and development prospects. As such, he said,

nearly all of the crude oil extracted from Liza-1

and Liza-2, Stabroek’s only producing sections,

comes from the Upper Campanian layer, which

is home to large, rich and hydrocarbon-dense

sand channels at depths of around 15,000 feet

(4,600 metres).

About 15 penetrations have been made in

the Upper Campanian interval, and they are not

optimally located, the CEO commented. There

are more attractive targets at greater depths of

around 18,000 feet (5,500 metres), he stated.

“In other words, when we were drilling to

the 15,000 feet, you could see on the seismic

that there is something material below it that’s at

18,000 [feet],” he said. “We saw there were sand

channels that mirror those which are 3,000 feet

[910 metres] above it and there is oil, but we hav-

en’t optimally located it and drilled for the best

18,000 feet target.”

The matter has become more urgent since Fangtooth, an oilfield west of Liza, contains deep-lying reserves (Image: Hess)

the discovery of oil at Fangtooth, a field to the

west of Liza, Hess stated. ExxonMobil and its determine the extent of the find, he said.

partners, including China National Offshore Oil Part of the goal of the appraisal drilling pro-

Corp. (CNOOC), have seen sizeable reserves in gramme is to decide whether the field can sup-

a prolific sand channel at Fangtooth, so they are port another floating production, storage and

drilling an appraisal well to the south-east to off-loading (FPSO) vessel, he added.

P8 www. NEWSBASE .com Week 48 30•November•2022