Page 5 - DMEA Week 17 2022

P. 5

DMEA COMMENTARY DMEA

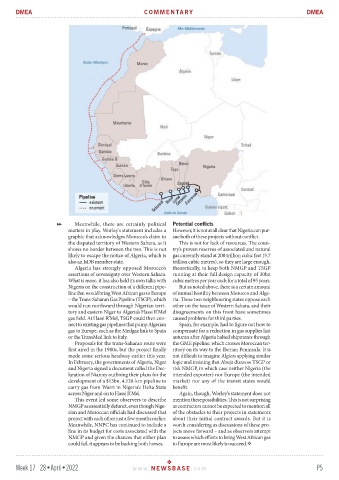

Meanwhile, there are certainly political Potential conflicts

matters in play. Worley’s statement includes a However, it is not at all clear that Nigeria can pur-

graphic that acknowledges Morocco’s claim to sue both of these projects without conflict.

the disputed territory of Western Sahara, as it This is not for lack of resources. The coun-

shows no border between the two. This is not try’s proven reserves of associated and natural

likely to escape the notice of Algeria, which is gas currently stand at 200 trillion cubic feet (5.7

also an IsDB member state. trillion cubic metres), so they are large enough,

Algeria has strongly opposed Morocco’s theoretically, to keep both NMGP and TSGP

assertions of sovereignty over Western Sahara. running at their full design capacity of 30bn

What is more, it has also held its own talks with cubic metres per year each for a total of 95 years.

Nigeria on the construction of a different pipe- But as noted above, there is a certain amount

line that would bring West African gas to Europe of mutual hostility between Morocco and Alge-

– the Trans-Saharan Gas Pipeline (TSGP), which ria. These two neighbouring states oppose each

would run northward through Nigerian terri- other on the issue of Western Sahara, and their

tory and eastern Niger to Algeria’s Hassi R’Mel disagreements on this front have sometimes

gas field. At Hassi R’Mel, TSGP could then con- caused problems for third parties.

nect to existing gas pipelines that pump Algerian Spain, for example, had to figure out how to

gas to Europe, such as the Medgaz link to Spain compensate for a reduction in gas supplies last

or the TransMed link to Italy. autumn after Algeria halted shipments through

Proposals for the trans-Saharan route were the GME pipeline, which crosses Moroccan ter-

first aired in the 1980s, but the project finally ritory on its way to the Iberian Peninsula. It is

made some serious headway earlier this year. not difficult to imagine Algiers applying similar

In February, the governments of Algeria, Niger logic and insisting that Abuja disavow TSGP or

and Nigeria signed a document called the Dec- risk NMGP, in which case neither Nigeria (the

laration of Niamey outlining their plans for the intended exporter) nor Europe (the intended

development of a $13bn, 4,128-km pipeline to market) nor any of the transit states would

carry gas from Warri in Nigeria’s Delta State benefit.

across Niger and on to Hassi R’Mel. Again, though, Worley’s statement does not

This event led some observers to describe mention these possibilities. This is not surprising

NMGP as essentially defunct, even though Nige- as contractors cannot be expected to mention all

rian and Moroccan officials had discussed that of the obstacles to their projects in statements

project with each other just a few months earlier. about their initial contract awards. But it is

Meanwhile, NNPC has continued to include a worth considering as discussions of these pro-

line in its budget for costs associated with the jects move forward – and as observers attempt

NMGP and given the chances that either plan to assess which efforts to bring West African gas

could fail, it appears to be backing both horses. to Europe are most likely to succeed.

Week 17 28•April•2022 www. NEWSBASE .com P5