Page 7 - FSUOGM Week 10 2023

P. 7

FSUOGM COMMENTARY FSUOGM

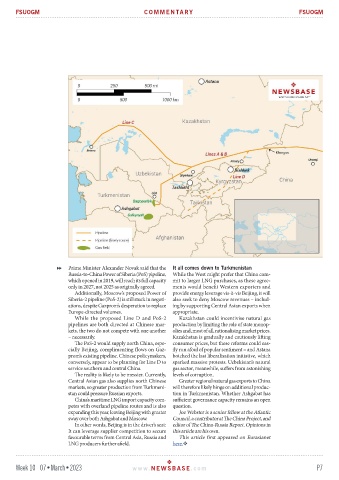

Prime Minister Alexander Novak said that the It all comes down to Turkmenistan

Russia-to-China Power of Siberia (PoS) pipeline, While the West might prefer that China com-

which opened in 2019, will reach its full capacity mit to larger LNG purchases, as these agree-

only in 2027, not 2025 as originally agreed. ments would benefit Western exporters and

Additionally, Moscow’s proposed Power of provide energy leverage vis-à-vis Beijing, it will

Siberia-2 pipeline (PoS-2) is still stuck in negoti- also seek to deny Moscow revenues – includ-

ations, despite Gazprom’s desperation to replace ing by supporting Central Asian exports when

Europe-directed volumes. appropriate.

While the proposed Line D and PoS-2 Kazakhstan could incentivise natural gas

pipelines are both directed at Chinese mar- production by limiting the role of state monop-

kets, the two do not compete with one another olies and, most of all, rationalising market prices.

– necessarily. Kazakhstan is gradually and cautiously lifting

The PoS-2 would supply north China, espe- consumer prices, but these reforms could eas-

cially Beijing, complimenting flows on Gaz- ily run afoul of popular sentiment – and Astana

prom’s existing pipeline. Chinese policymakers, botched the last liberalisation initiative, which

conversely, appear to be planning for Line D to sparked massive protests. Uzbekistan’s natural

service southern and central China. gas sector, meanwhile, suffers from astonishing

The reality is likely to be messier. Currently, levels of corruption.

Central Asian gas also supplies north Chinese Greater regional natural gas exports to China

markets, so greater production from Turkmeni- will therefore likely hinge on additional produc-

stan could pressure Russian exports. tion in Turkmenistan. Whether Ashgabat has

China’s maritime LNG import capacity com- sufficient governance capacity remains an open

petes with overland pipeline routes and is also question.

expanding this year, leaving Beijing with greater Joe Webster is a senior fellow at the Atlantic

sway over both Ashgabat and Moscow. Council, a contributor at The China Project, and

In other words, Beijing is in the driver’s seat: editor of The China-Russia Report. Opinions in

It can leverage supplier competition to secure this article are his own.

favourable terms from Central Asia, Russia and This article first appeared on Eurasianet

LNG producers further afield. here.

Week 10 07•March•2023 www. NEWSBASE .com P7