Page 11 - AsianOil Week 18 2021

P. 11

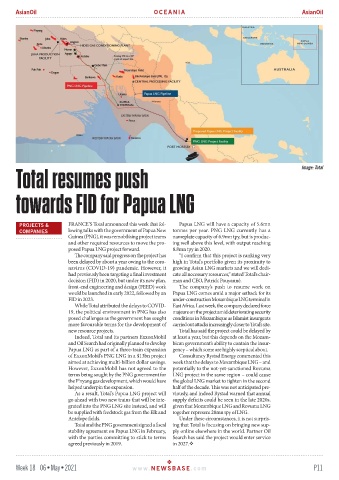

AsianOil OCEANIA AsianOil

Total resumes push Image: Total

towards FID for Papua LNG

PROJECTS & FRANCE’S Total announced this week that fol- Papua LNG will have a capacity of 5.6mn

COMPANIES lowing talks with the government of Papua New tonnes per year. PNG LNG currently has a

Guinea (PNG), it was remobilising project teams nameplate capacity of 6.9mn tpy, but is produc-

and other required resources to move the pro- ing well above this level, with output reaching

posed Papua LNG project forward. 8.8mn tpy in 2020.

The company said progress on the project has “I confirm that this project is ranking very

been delayed by about a year owing to the coro- high in Total’s portfolio given its proximity to

navirus (COVID-19) pandemic. However, it growing Asian LNG markets and we will dedi-

had previously been targeting a final investment cate all necessary resources,” stated Total’s chair-

decision (FID) in 2020, but under its new plan, man and CEO, Patrick Pouyanné.

front-end engineering and design (FEED) work The company’s push to resume work on

would be launched in early 2022, followed by an Papua LNG comes amid a major setback for its

FID in 2023. under-construction Mozambique LNG terminal in

While Total attributed the delays to COVID- East Africa. Last week, the company declared force

19, the political environment in PNG has also majeure on the project amid deteriorating security

posed challenges as the government has sought conditions in Mozambique as Islamist insurgents

more favourable terms for the development of carried out attacks increasingly closer to Total’s site.

new resource projects. Total has said the project could be delayed by

Indeed, Total and its partners ExxonMobil at least a year, but this depends on the Mozam-

and Oil Search had originally planned to develop bican government’s ability to contain the insur-

Papua LNG as part of a three-train expansion gency – which some are highly sceptical about.

of ExxonMobil’s PNG LNG in a $13bn project Consultancy Rystad Energy commented this

aimed at achieving multi-billion dollar savings. week that the delays to Mozambique LNG – and

However, ExxonMobil has not agreed to the potentially to the not-yet-sanctioned Rovuma

terms being sought by the PNG government for LNG project in the same region – could cause

the P’nyang gas development, which would have the global LNG market to tighten in the second

helped underpin the expansion. half of the decade. This was not anticipated pre-

As a result, Total’s Papua LNG project will viously, and indeed Rystad warned that annual

go ahead with two new trains that will be inte- supply deficits could be seen in the late 2020s,

grated into the PNG LNG site instead, and will given that Mozambique LNG and Rovuma LNG

be supplied with feedstock gas from the Elk and together represent 28mn tpy of LNG.

Antelope fields. Under these circumstances, it is not surpris-

Total and the PNG government signed a fiscal ing that Total is focusing on bringing new sup-

stability agreement on Papua LNG in February, ply online elsewhere in the world. Partner Oil

with the parties committing to stick to terms Search has said the project would enter service

agreed previously in 2019. in 2027.

Week 18 06•May•2021 www. NEWSBASE .com P11