Page 3 - E-MODUL MANAJEMEN INVESTASI DAN PASAR MODAL

P. 3

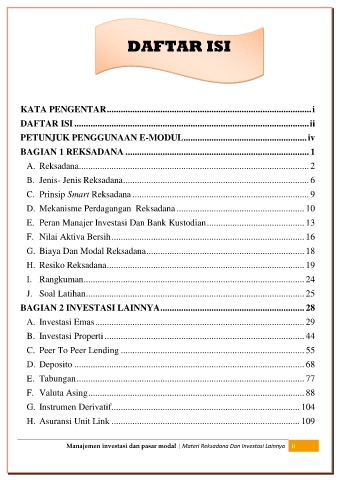

DAFTAR ISI

KATA PENGENTAR ........................................................................................ i

DAFTAR ISI ..................................................................................................... ii

PETUNJUK PENGGUNAAN E-MODUL..................................................... iv

BAGIAN 1 REKSADANA ............................................................................... 1

A. Reksadana ................................................................................................... 2

B. Jenis- Jenis Reksadana ................................................................................ 6

C. Prinsip Smart Reksadana ............................................................................ 9

D. Mekanisme Perdagangan Reksadana ....................................................... 10

E. Peran Manajer Investasi Dan Bank Kustodian .......................................... 13

F. Nilai Aktiva Bersih ................................................................................... 16

G. Biaya Dan Modal Reksadana .................................................................... 18

H. Resiko Reksadana ..................................................................................... 19

I. Rangkuman ............................................................................................... 24

J. Soal Latihan .............................................................................................. 25

BAGIAN 2 INVESTASI LAINNYA .............................................................. 28

A. Investasi Emas .......................................................................................... 29

B. Investasi Properti ...................................................................................... 44

C. Peer To Peer Lending ............................................................................... 55

D. Deposito ................................................................................................... 68

E. Tabungan .................................................................................................. 77

F. Valuta Asing ............................................................................................. 88

G. Instrumen Derivatif................................................................................. 104

H. Asuransi Unit Link ................................................................................. 109

Manajemen investasi dan pasar modal | Materi Reksadana Dan Investasi Lainnya ii