Page 11 - Premier Banking Booklet

P. 11

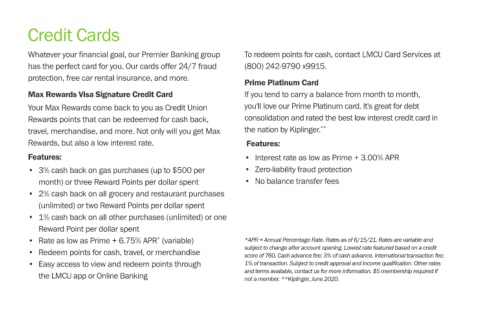

Credit Cards

Whatever your financial goal, our Premier Banking group To redeem points for cash, contact LMCU Card Services at

has the perfect card for you. Our cards offer 24/7 fraud (800) 242-9790 x9915.

protection, free car rental insurance, and more.

Prime Platinum Card

Max Rewards Visa Signature Credit Card If you tend to carry a balance from month to month,

Your Max Rewards come back to you as Credit Union you'll love our Prime Platinum card. It's great for debt

Rewards points that can be redeemed for cash back, consolidation and rated the best low interest credit card in

travel, merchandise, and more. Not only will you get Max the nation by Kiplinger. **

Rewards, but also a low interest rate. Features:

Features: • Interest rate as low as Prime + 3.00% APR

• 3% cash back on gas purchases (up to $500 per • Zero-liability fraud protection

month) or three Reward Points per dollar spent • No balance transfer fees

• 2% cash back on all grocery and restaurant purchases

(unlimited) or two Reward Points per dollar spent

• 1% cash back on all other purchases (unlimited) or one

Reward Point per dollar spent

*

• Rate as low as Prime + 6.75% APR (variable) *APR = Annual Percentage Rate. Rates as of 6/15/21. Rates are variable and

• Redeem points for cash, travel, or merchandise subject to change after account opening. Lowest rate featured based on a credit

score of 760. Cash advance fee: 3% of cash advance. International transaction fee:

• Easy access to view and redeem points through 1% of transaction. Subject to credit approval and income qualification. Other rates

the LMCU app or Online Banking and terms available, contact us for more information. $5 membership required if

not a member. **Kiplinger, June 2020.