Page 59 - Noble's TMT Consumer Virtual Equity Conference 2024

P. 59

Vince Holding Corp.

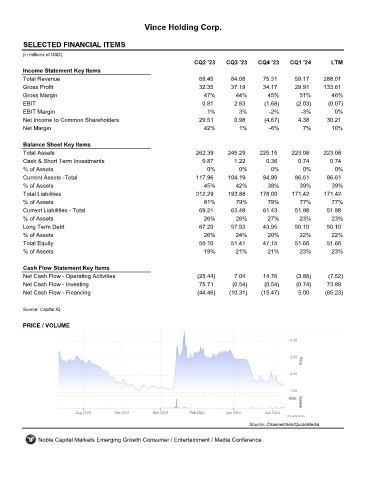

SELECTED FINANCIAL ITEMS VNCE

(in millions of USD)

CQ2 '23 CQ3 '23 CQ4 '23 CQ1 '24 LTM

Income Statement Key Items

Total Revenue 69.45 84.08 75.31 59.17 288.01

Gross Profit 32.35 37.19 34.17 29.91 133.61

Gross Margin 47% 44% 45% 51% 46%

EBIT 0.81 2.83 (1.68) (2.03) (0.07)

EBIT Margin 1% 3% -2% -3% 0%

Net Income to Common Shareholders 29.51 0.98 (4.67) 4.38 30.21

Net Margin 42% 1% -6% 7% 10%

Balance Sheet Key Items

Total Assets 262.39 245.29 225.15 223.08 223.08

Cash & Short Term Investments 0.87 1.22 0.36 0.74 0.74

% of Assets 0% 0% 0% 0% 0%

Current Assets -Total 117.96 104.19 84.80 86.61 86.61

% of Assets 45% 42% 38% 39% 39%

Total Liabilities 212.29 193.88 178.00 171.42 171.42

% of Assets 81% 79% 79% 77% 77%

Current Liabilities - Total 69.21 63.48 61.43 51.98 51.98

% of Assets 26% 26% 27% 23% 23%

Long Term Debt 67.20 57.93 43.95 50.10 50.10

% of Assets 26% 24% 20% 22% 22%

Total Equity 50.10 51.41 47.15 51.66 51.66

% of Assets 19% 21% 21% 23% 23%

Cash Flow Statement Key Items

Net Cash Flow - Operating Activities (25.44) 7.04 14.76 (3.88) (7.52)

Net Cash Flow - Investing 75.71 (0.54) (0.54) (0.74) 73.89

Net Cash Flow - Financing (44.46) (10.31) (15.47) 5.00 (65.23)

Source: Capital IQ

PRICE / VOLUME

Source: Channelchek/QuoteMedia

Noble Capital Markets Emerging Growth Consumer / Entertainment / Media Conference