Page 12 - Builder Brief October 2024

P. 12

ECONOMY

WHAT FED RATE CUT MEANS FOR

HOUSING

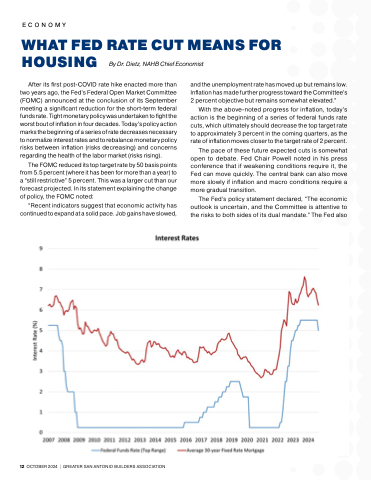

After its first post-COVID rate hike enacted more than two years ago, the Fed’s Federal Open Market Committee (FOMC) announced at the conclusion of its September meeting a significant reduction for the short-term federal funds rate. Tight monetary policy was undertaken to fight the worst bout of inflation in four decades. Today’s policy action marks the beginning of a series of rate decreases necessary to normalize interest rates and to rebalance monetary policy risks between inflation (risks decreasing) and concerns regarding the health of the labor market (risks rising).

The FOMC reduced its top target rate by 50 basis points from 5.5 percent (where it has been for more than a year) to a “still restrictive” 5 percent. This was a larger cut than our forecast projected. In its statement explaining the change of policy, the FOMC noted:

“Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed,

and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.”

With the above-noted progress for inflation, today’s action is the beginning of a series of federal funds rate cuts, which ultimately should decrease the top target rate to approximately 3 percent in the coming quarters, as the rate of inflation moves closer to the target rate of 2 percent.

The pace of these future expected cuts is somewhat open to debate. Fed Chair Powell noted in his press conference that if weakening conditions require it, the Fed can move quickly. The central bank can also move more slowly if inflation and macro conditions require a more gradual transition.

The Fed’s policy statement declared, “The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.” The Fed also

By Dr. Dietz, NAHB Chief Economist

12 OCTOBER 2024 | GREATER SAN ANTONIO BUILDERS ASSOCIATION