Page 11 - BPS PFAR Report Fiscal Year 2021

P. 11

How BPS Is Funded FY21 Revenue -

FY20 Revenue - All Governmental Funds

All Governmental Funds

Food Services

Grant Funds

Capital Funds

Debt Services and Internal Funds

General Fund

General Fund

FY19 FY20 FY21

Local

Property Taxes

$ 196,789,468

$ 2,858,818

$ 9,297,195

35.49% 0.52% 1.68%

$ 200,038,732

$ 1,852,722

$ 9,575,351

35.61% 0.33% 1.69%

$ 209,714,803

36.48%

Investments Other

$ 120,058 $ 11,171,486

0.02% 1.94%

State

FEFP

$ 245,026,986 $ 83,910,092 13,533,232

44.19% 15.13% 2.44%

$ 258,418,786 $ 86,062,876 $ 5,191,854

45.55% 15.17% 0.92%

$ 262,434,270

45.65%

Categoricals

$ 82,404,103

14.33%

Other (Includes

$ 4,250,031

0.74%

Federal

Direct Grants

$ 786,547 $ 2,278,768

0.14% 0.41%

$ 595,095 $ 3,576,681

0.10% 0.63%

$ 769,392 $ 4,068,023

0.13% 0.71%

TOTAL

$ 554,481,106

100.00%

$ 567,312,097

100.00%

$ 574,932,166

100.00%

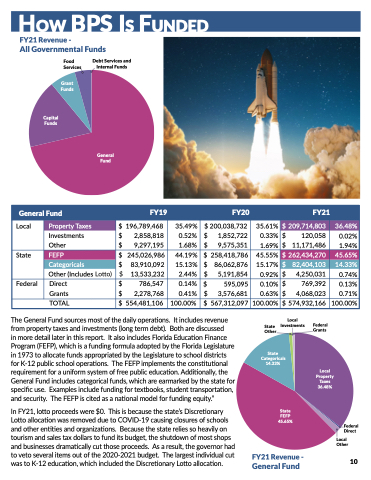

TheGeneralFundsourcesmostofthedailyoperations. Itincludesrevenue

Local Investments

Capital Fund

FY19 FY20

FY21

frompropertytaxesandinvestments(longtermdebt). Botharediscussed inmoredetaillaterinthisreport. ItalsoincludesFloridaEducationFinance

State Other

Federal

SalesSurtax $ 47,429,873 35.49% $ 46,693,650 33.19% $ 51,591,468 34.26%

in 1973 to allocate funds appropriated by the Legislature to school districts State L

Investments $

3,062,580 2.29%

$ 2,838,085 2.02% $ 173,175 0.11% O

for K-12 public school operations. The FEFP implements the constitutional

Categoricals

ImpactFees $ 13,734,323 10.28% $ 16,004,661 11.38% $ 18,549,679 12.32%

requirement for a uniform system of free public education. Additionally, the

Local

Other $

189,337 0.14% $ 399,953 0.28%

$ 374,578 0.25%

General Fund includes categorical funds, which are earmarked by the state for

Property

State PECO $ 4,750,036 3.55% $ 3,580,967 2.55%

$ 4,080,505 2.71%

$ 5,013,790 3.33%

$ - 0.00%

specificuse. Examplesincludefundingfortextbooks,studenttransportation,

Other $ 2,993,795 2.24% $ 5,107,324 3.63%

and security. The FEFP is cited as a national model for funding equity.”

Federal N/A $ - 0.00% $ - 0.00%

In FY21, lotto proceeds were $0. This is because the state’s Discretionary

State FEFP

TOTAL $ 133,641,622 100.00% $ 140,690,426 100.00%

$ 150,587,689 100.00%

Lotto allocation was removed due to COVID-19 causing closures of schools andotherentitiesandorganizations. Becausethestatereliessoheavilyon touGrirsamnatnFdusnadles tax dollars to fund its budget, tFhYe1sh9utdown of most shops FY20 and businesses dramatically cut those proceeds. As a result, the governor had

45.65%

FY21

Federal Direct

Local Other

Local Other $

493 0.00%

$ 100

0.00%

$

- 0.00%

to veto several items out of the 2020-2021 budget. The largest individual cut

FY21 Revenue -

State Other $

43,620 0.09%

$ 43,132

0.08% $

31,133

0.04%

was to K-12 education, which included the Discretionary Lotto allocation.

FY21 Revenue - Food Services

10

Federal Direct $ 5,639,005 11.01% $ 5,959,232

Grants $ 45529971 8890% $ 46774724 8863% $ 66720909 9128%

14.33%

General Fund

11.29% $ 6,343,572

8.68%

Grants

Local PropertyTaxes $ 61,481,678 46.00% $ 66,065,786 46.96% $ 70,804,494 47.02% Program (FEFP), which is a funding formula adopted by the Florida Legislature

Taxes 36.48%

,,,,,,

L

o