Page 12 - BPS PFAR Report Fiscal Year 2021

P. 12

Federal Direct $ 786547 014% $ 595095 010% $ 769392 013%

Federal N/A $ 000% $ 000% $

000%

R

l

,.,.,. 2,278,768 0.41% $ 3,576,681 0.63% $ 4,068,023 0.71% TOTAL $ 554,481,106 100.00% $ 567,312,097 100.00% $ 574,932,166 100.00%

Grants $

How BPS Is Funded (continued)

Debt Services

FY19 FY20 FY21

Grant Fund

FY21 Revenue - Food Services

FY19

FY20 FY21

Local

Local

Investments

Other

$

$ 164,729

493

27.43%

0.00%

$ 133,368

$ 100

FY21 Re

28.05%

0.00%

venue - Debt S

$ 46

$-

ervices

0.01%F 0.00%

State

Other

Other

$$ 43,620 -

0.00%

0.09%

$-

$ 43,132

0.00%

0.08%

$-

$ 31,133

0.00%

0.04%

State

Federal

Federal

Other

Direct

Fo

$ 435,774

Local

$ 5,639,005

od Sales

8.3$2% - $ 45,529,971

72.57%

11.01%

0.00%

88.90%

$ 342,045

$ 5,959,232

$-

$ 46,774,724

71.95%

11.29%

0.00%

88.63%

$ 311,712

$ 6,343,572

99.99%

8.68%

N/A

Grants

$-

$ 66,720,909

0.00%

91.28%

TOTAL

TOTAL

FY21 Revenue - Grant Funds

$

$ 600,503

51,213,089

100.00%

100.00%

$ 475,413

$ 52,777,188

100.00%

100.00%

$ 311,758

$ 73,095,614

100.00%

100.00%

Y21

Food Services Federal

Local

State Federal

FY19 FY20 FY21

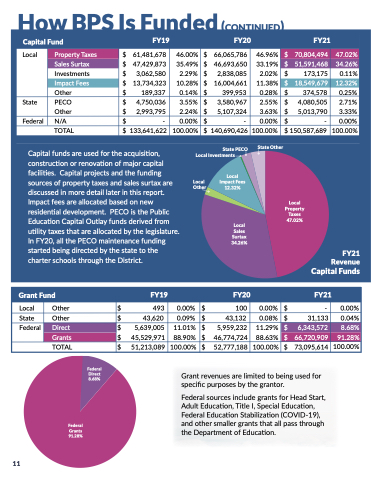

Grant revenues are limited to being used for

Debt Services

FY20

FY21

Local

11

State

Investments Other Other

$ 133,368 28.05% $

Direct Food Sales 8.68%

$ 9,510,027 27.17% $ 7,252,554 21.33% $ 3,383,801 8.32%Capita

Federal Other Food Services

$ 13,067

$ 340,223

specific purposes by the grantor.

Funds

Food Services

Food Services

TOTAL

Adult Education, Title I, Special Education,

Federal Grants 91.28%

99.99%

90.16%

0.04% $ 41,112 0.12% $ 285,232 0F.9e7d%era$l source3s47in,1c8lu8de g1ra.0n2t%s fo$r Head33S2ta,8r0t,7

0.70% .82%

$ 25,132,432 71.82% $ 26,355,335 77.52% $ 36,666,862 90.16%

FY19

the Department of Education.

46 0.01% - 0.00% $ 342,045 71.95% $ 311,712 99.99%

State

Federal Education StabilizOathtieron (COVID-19),

$ 34,995,749 100.00% $ 33,996,189 100.00% $ 40,668,702 100.00%

and other smaller grants that all pass through

$ 164,729 27.43%

$ - 0.00% $ - 0.00% $ $ 435,774 72.57%

FY19 FY20 FY21 Local $ 61,481,678 46.00% $ 66,065,786 46.96%

Capital Fund

General

FY19 FY20

Property Taxes

Sales Surtax

Investments

PrIomppeartcyt TFaexeess

InvOetshtemrents

$ 47,429,873 35.49% $ 46,693,650 33.19%

$ 3,062,580 2.29% $ 2,838,085 2.02% Local $$19163,7,78394,4,36283 3150.4298% $ 21060,00348,,676312 1315..3681% $$ 2,815889,,831387 0.5124% $ 13,89592,9,75232 0.2.383%

$ 70,804,494

$ 51,591,468

$ 173,175

$ 20198,,751449,860739

$ 132740,50758

47.02%

34.26%

0.11%

1326..3428%

State

State

Federal

O tPhEeCr O FEOFtPher

CaNte/Agoricals

OtThOeTr A(ILncludes

$$ 94,2,79570,,109356 $$ 2452,092963,978965

$$ 83,910,092-

$ 133,5,63431,2,6322

13.6585% 424.2149%

105.0103%

1020.4040%

$ 39,5,58705,9,36571 $ 258,1,40178,3,72846

$ 86,062,87-6

$ 1405,61901,,482564

21.5.659% 435.6.535%

105.0.107%

100.0.902%

$ 114,107810,458065 $ 2625,403143,27790

$ 82,404,103-

$ 1504,528570,608391

0.2.052%

21.7.914% 435.3.635%

104.0.303%

100.00%

0.74%

Fund

Federal Direct GrantFuGnrdants

Local $ 786,547 0.14% $

FY21

595,095 0.10% $ 769,392 0.13%

Investments Federal State PECO

$ 2,278,F7Y6819 0.41% $ 3,576F,6Y8210 0.63% $ 4,068F,0Y2231 0.71%

State

Capital funds are used for the acqGuraisntistion, Local Investments

TOTAL Other $ 554,481,106 100.00% $ 567,312,097 100.00% $ 574,932,166 100.00%

Loccoanl structiOothneor r renovation of$major capi4ta9l3 0.00% $ Stfatceilities.OCthaeprital projects and$ the fun4d3i,n6g20 0.09% $

100 43,132

0.00%

$ - 0.00%

State

Local

0.08%

11.29%

$

31,133 0.04%

Fesdoeurracles oDfirpercotperty taxes and$sales5,s6u3r9t,a0x05are 11.01% $

Capital Fund Categoricals 14.33%

Local

Impact Fees

$

$ 66,720,909 91.28%

FY19

FY20

FY21

5,959,232

6,343,572 8.68%

State Other

discussedGirnanmtsore detail later$in th4i5s,5re2p9o,9r7t.1 88.90%

$ 46,774,724 88.63%

$ 70,804,494 47.02%

Local PropertyTaxes $ 61,481,678 46.00% Local

$ 66,065,786 46.96%

$Lo7ca3l,095,614 100.00% $ 51,591,468 34.26%

Impact feTeOsTaArLe allocated bas$ed o5n1n,2e1w3,089 100.00% Property

$ 52,777,188 100.00%

Food Services

FY19

FY20

47.02% FY21

$ 18,549,679 12.32%

SalesSurtax $ 47,429,873 35.49% Taxes

$ 46,693,650 33.19% $ 2,838,085 2.02%

Property

residential development. PECO is the Public

Taxes

Investments $

ImpactFees $ 13,734,323 10.28% utility taxes that are allocated by the legislature.

$ 173,175 0.11%

Education Capital Outlay funds derived from

$ 16,004,661 11.38%

Local Food Sales $ Other $

9,510,027 27.17%

Local

In FY20, all the PECO maintenance funding

Other State $ 13,067 0.04%

$

4314,.1261%2 0.12% 3,580,967 2.55%

$

285,232

0.70%

State PECO $

4,750,036 3.55%

$

$

4,080,505

2.71%

started being directed by the state to the

State Food Services FEFP $ 340,223 0.97%

$

347,188 1.02% 5,107,324 3.63%

$

332,807

.82%

Other 45.65%

charter schools through the District.

2.24%

$

Federal FoodServices Federal N/A

$ 25,132,432 71.82%

$ 26,355,335 77.52% $ - 0.00%

$

36,666,862 90.16%

TOTAL

$ 40,66C8,a7p02ita1l0F0u.0n0d%s $ 150,587,689 100.00%

TOTAL

$ 133,641,622 100.00%

3,062,580 2.29%

36.48%

189,337 0.14%

$

Sales

$

374,578

0.25%

$ 2,993,795

$ - Direc0t.00% $ 34,995,749 100.00%

3.33%

Local

Other

Federal

$

Revenue

Other

12.32%

$

7,252,554 21.33% 399S,9ur5ta3x 0.28%

$

3,383,801

8.32%

$ 33,996,189 100.00% $ 140,690,426 100.00%

- 0.00%

$

5,013,790

FY21