Page 9 - Westminster Presbyterian

P. 9

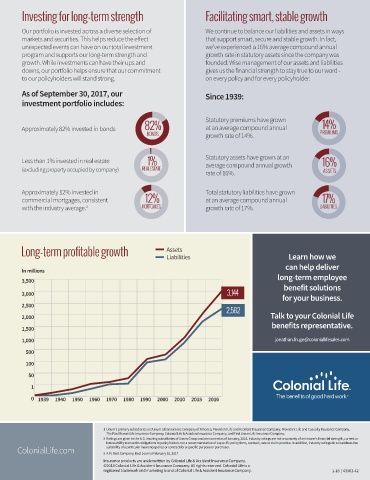

Investing for long-term strength Facilitating smart, stable growth

Our portfolio is invested across a diverse selection of We continue to balance our liabilities and assets in ways

markets and securities. This helps reduce the effect that support smart, secure and stable growth. In fact,

unexpected events can have on our total investment we’ve experienced a 16% average compound annual

program and supports our long-term strength and growth rate in statutory assets since the company was

growth. While investments can have their ups and founded. Wise management of our assets and liabilities

downs, our portfolio helps ensure that our commitment gives us the financial strength to stay true to our word -

to our policyholders will stand strong. on every policy and for every policyholder.

As of September 30, 2017, our Since 1939:

investment portfolio includes:

82% Statutory premiums have grown 14%

Approximately 82% invested in bonds at an average compound annual

BONDS growth rate of 14%. PREMIUMS

Less than 1% invested in real estate 1% Statutory assets have grown at an 16%

average compound annual growth

(excluding property occupied by company) REAL ESTATE ASSETS

rate of 16%.

Approximately 12% invested in Total statutory liabilities have grown

commercial mortgages, consistent 12% at an average compound annual 17%

with the industry average. 3 MORTGAGES growth rate of 17%. LIABILITIES

Long-term profitable growth Assets Learn how we

Liabilities

can help deliver

In millions

long-term employee

3,500

benefit solutions

3,000 3,144

for your business.

2,500

2,582

2,000 Talk to your Colonial Life

benefits representative.

1,500

1,000 jonathan.fruge@coloniallifesales.com

500

100

50

1

0 1939 1940 1950 1960 1970 1980 1990 2000 2010 2015 2016

1 Unum’s primary subsidiaries are Unum Life Insurance Company of America, Provident Life and Accident Insurance Company, Provident Life and Casualty Insurance Company,

The Paul Revere Life Insurance Company, Colonial Life & Accident Insurance Company, and First Unum Life Insurance Company.

2 Ratings are given to the U.S. insuring subsidiaries of Unum Group and are current as of January, 2018. Industry ratings are not a warranty of an insurer’s financial strength, current or

future ability to meet its obligations to policyholders nor a recommendation of a specific policy form, contract, rate or claim practice. In addition, industry ratings do not address the

ColonialLife.com 3 A.M. Best Company, Best Journal February 20, 2017

suitability of a particular insurance policy or contract for a specific purpose or purchaser.

Insurance products are underwritten by Colonial Life & Accident Insurance Company.

©2018 Colonial Life & Accident Insurance Company. All rights reserved. Colonial Life is a

registered trademark and marketing brand of Colonial Life & Accident Insurance Company. 1-18 | 43562-42