Page 24 - IMF-欧洲的金融科技:机遇与挑战(英文)-2020.11-35页.pdf

P. 24

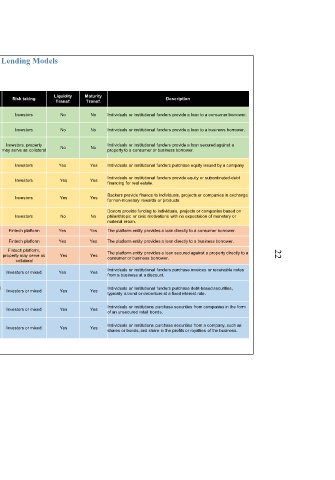

Table 2. Fintech Lending Models

Liquidity Maturity

Finance model Funding Source Borrowers Risk taking Description

Transf. Transf.

Individuals or institutional

P2P Consumer Lending Individuals Investors No No Individuals or institutional funders provide a loan to a consumer borrower.

investors

Individuals or institutional

P2P Business Lending Business Investors No No Individuals or institutional funders provide a loan to a business borrower.

P2P Lending investors

Individuals or institutional Individuals or business Investors, property Individuals or institutional funders provide a loan secured against a

P2P Property Lending No No

investors (property owner) may serve as collateral property to a consumer or business borrower.

Individuals or institutional

Equity-based Crowdfunding Business (equity issuer) Investors Yes Yes Individuals or institutional funders purchase equity issued by a company

investors

Individuals or institutional Business Individuals or institutional funders provide equity or subordinated-debt

Real Estate Crowdfunding Investors Yes Yes

investors (real estate developer) financing for real estate.

Crowdfunding

Reward-based Crowdfunding Backers Individuals or business Investors Yes Yes Backers provide finance to individuals, projects or companies in exchange

for non-monetary rewards or products

Donors provide funding to individuals, projects or companies based on

Donation-based Crowdfunding Donors Individuals or business Investors No No philanthropic or civic motivations with no expectation of monetary or

material return.

Balance Sheet Consumer Lending Fintech platform Individuals Fintech platform Yes Yes The platform entity provides a loan directly to a consumer borrower.

Balance Sheet Business Lending Fintech platform Individuals Fintech platform Yes Yes The platform entity provides a loan directly to a business borrower.

Balance Sheet Model

Fintech platform,

Individuals or business The platform entity provides a loan secured against a property directly to a

Balance Sheet Property Lending Fintech platform property may serve as Yes Yes 22

(property owner) consumer or business borrower.

collateral

Individuals or institutional Individuals or institutional funders purchase invoices or receivable notes

Invoice trading Business (invoice owner) Investors or mixed Yes Yes

investors from a business at a discount.

Individuals or institutional Business (issuer of debt-based Individuals or institutional funders purchase debt-based securities,

Debt-based Securities Investors or mixed Yes Yes

investors securities) typically a bond or debenture at a fixed interest rate.

Other models

Individuals or institutional Business (unsecured retail Individuals or institutions purchase securities from companies in the form

Mini-Bonds Investors or mixed Yes Yes

investors bond issuer) of an unsecured retail bonds.

Individuals or institutional Individuals or institutions purchase securities from a company, such as

Profit-Sharing Business Investors or mixed Yes Yes

investors shares or bonds, and share in the profits or royalties of the business.