Page 469 - FINAL MASTER 616pp 20-6-19

P. 469

What you preferred, but they are MHML accounts, not yours, was to breakdown Surveyor’s fees, our MHML invoice amount etc. As you are well aware, all our costs on the s.20 notice dated 22 June 2014 included vat & fees [easy, NOT transparent I agree, but much preferred to know the full monty as opposed to plus fees [what fees?], plus vat.... I’m no mathematician and neither I propose are all of our lessees – even Maunder Taylor are adopting the same costs incl. vat and fees, so they are making things simpler.

Mrs Hillgarth simply found yet another thing to bitch about and complained that firstly professionals quote ex vat and no way would she agree to [anything] having the internals and externals run concurrently as no savings could be made [let alone the inconvenience of having works done over two years]. Recent Maunder Taylor preference is to run our next internals/externals concurrently and advised a small but useful saving.

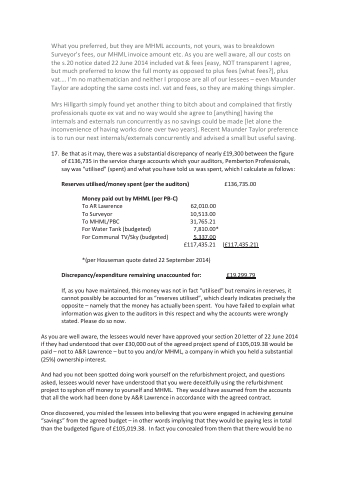

17. Be that as it may, there was a substantial discrepancy of nearly £19,300 between the figure of £136,735 in the service charge accounts which your auditors, Pemberton Professionals, say was “utilised” (spent) and what you have told us was spent, which I calculate as follows:

Reserves utilised/money spent (per the auditors)

Money paid out by MHML (per PB-C)

To AR Lawrence

To Surveyor

To MHML/PBC

For Water Tank (budgeted)

For Communal TV/Sky (budgeted)

£136,735.00

5,337.00

£117,435.21 (£117,435.21)

62,010.00 10,513.00 31,765.21

7,810.00*

*(per Houseman quote dated 22 September 2014) Discrepancy/expenditure remaining unaccounted for: £19,299.79

If, as you have maintained, this money was not in fact “utilised” but remains in reserves, it cannot possibly be accounted for as “reserves utilised”, which clearly indicates precisely the opposite – namely that the money has actually been spent. You have failed to explain what information was given to the auditors in this respect and why the accounts were wrongly stated. Please do so now.

As you are well aware, the lessees would never have approved your section 20 letter of 22 June 2014 if they had understood that over £30,000 out of the agreed project spend of £105,019.38 would be paid – not to A&R Lawrence – but to you and/or MHML, a company in which you held a substantial (25%) ownership interest.

And had you not been spotted doing work yourself on the refurbishment project, and questions asked, lessees would never have understood that you were deceitfully using the refurbishment project to syphon off money to yourself and MHML. They would have assumed from the accounts that all the work had been done by A&R Lawrence in accordance with the agreed contract.

Once discovered, you misled the lessees into believing that you were engaged in achieving genuine “savings” from the agreed budget – in other words implying that they would be paying less in total than the budgeted figure of £105,019.38. In fact you concealed from them that there would be no