Page 134 - Accounting Principles (A Business Perspective)

P. 134

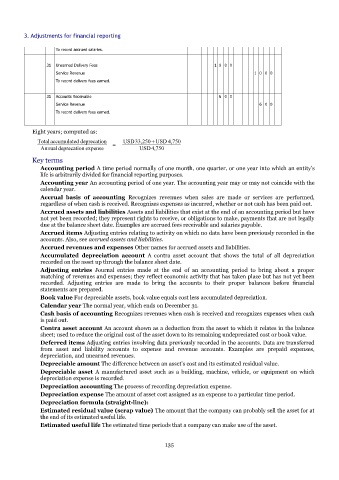

3. Adjustments for financial reporting

To record accrued salaries.

31 Unearned Delivery Fees 1 0 0 0

Service Revenue 1 0 0 0

To record delivery fees earned.

31 Accounts Receivable 6 0 0

Service Revenue 6 0 0

To record delivery fees earned.

Eight years; computed as:

Total accumulated deprecation = USD33,250USD 4,750

Annual deprecation expense USD4,750

Key terms

Accounting period A time period normally of one month, one quarter, or one year into which an entity’s

life is arbitrarily divided for financial reporting purposes.

Accounting year An accounting period of one year. The accounting year may or may not coincide with the

calendar year.

Accrual basis of accounting Recognizes revenues when sales are made or services are performed,

regardless of when cash is received. Recognizes expenses as incurred, whether or not cash has been paid out.

Accrued assets and liabilities Assets and liabilities that exist at the end of an accounting period but have

not yet been recorded; they represent rights to receive, or obligations to make, payments that are not legally

due at the balance sheet date. Examples are accrued fees receivable and salaries payable.

Accrued items Adjusting entries relating to activity on which no data have been previously recorded in the

accounts. Also, see accrued assets and liabilities.

Accrued revenues and expenses Other names for accrued assets and liabilities.

Accumulated depreciation account A contra asset account that shows the total of all depreciation

recorded on the asset up through the balance sheet date.

Adjusting entries Journal entries made at the end of an accounting period to bring about a proper

matching of revenues and expenses; they reflect economic activity that has taken place but has not yet been

recorded. Adjusting entries are made to bring the accounts to their proper balances before financial

statements are prepared.

Book value For depreciable assets, book value equals cost less accumulated depreciation.

Calendar year The normal year, which ends on December 31.

Cash basis of accounting Recognizes revenues when cash is received and recognizes expenses when cash

is paid out.

Contra asset account An account shown as a deduction from the asset to which it relates in the balance

sheet; used to reduce the original cost of the asset down to its remaining undepreciated cost or book value.

Deferred items Adjusting entries involving data previously recorded in the accounts. Data are transferred

from asset and liability accounts to expense and revenue accounts. Examples are prepaid expenses,

depreciation, and unearned revenues.

Depreciable amount The difference between an asset’s cost and its estimated residual value.

Depreciable asset A manufactured asset such as a building, machine, vehicle, or equipment on which

depreciation expense is recorded.

Depreciation accounting The process of recording depreciation expense.

Depreciation expense The amount of asset cost assigned as an expense to a particular time period.

Depreciation formula (straight-line):

Estimated residual value (scrap value) The amount that the company can probably sell the asset for at

the end of its estimated useful life.

Estimated useful life The estimated time periods that a company can make use of the asset.

135