Page 189 - Accounting Principles (A Business Perspective)

P. 189

This book is licensed under a Creative Commons Attribution 3.0 License

Alternate problems

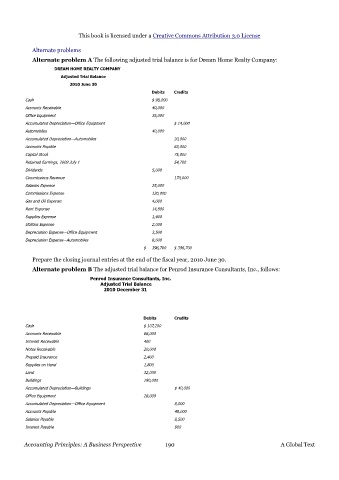

Alternate problem A The following adjusted trial balance is for Dream Home Realty Company:

DREAM HOME REALTY COMPANY

Adjusted Trial Balance

2010 June 30

Debits Credits

Cash $ 98,000

Accounts Receivable 40,000

Office Equipment 35,000

Accumulated Depreciation—Office Equipment $ 14,000

Automobiles 40,000

Accumulated Depreciation—Automobiles 20,000

Accounts Payable 63,000

Capital Stock 75,000

Retained Earnings, 2009 July 1 54,700

Dividends 5,000

Commissions Revenue 170,000

Salaries Expense 25,000

Commissions Expense 120,000

Gas and Oil Expense 4,000

Rent Expense 14,800

Supplies Expense 1,400

Utilities Expense 2,000

Depreciation Expense—Office Equipment 3,500

Depreciation Expense—Automobiles 8,000

$ 396,700 $ 396,700

Prepare the closing journal entries at the end of the fiscal year, 2010 June 30.

Alternate problem B The adjusted trial balance for Penrod Insurance Consultants, Inc., follows:

Penrod Insurance Consultants, Inc.

Adjusted Trial Balance

2010 December 31

Debits Credits

Cash $ 107,200

Accounts Receivable 68,000

Interest Receivable 400

Notes Receivable 20,000

Prepaid Insurance 2,400

Supplies on Hand 1,800

Land 32,000

Buildings 190,000

Accumulated Depreciation—Buildings $ 40,000

Office Equipment 28,000

Accumulated Depreciation—Office Equipment 8,000

Accounts Payable 48,000

Salaries Payable 8,500

Interest Payable 900

Accounting Principles: A Business Perspective 190 A Global Text