Page 245 - Accounting Principles (A Business Perspective)

P. 245

This book is licensed under a Creative Commons Attribution 3.0 License

was the cost of goods sold during the period. Of course, the USD 154,000 is not necessarily the precise amount of

goods sold because no actual record was made of the dollar cost of the goods sold. Periodic inventory procedure

basically assumes that everything not on hand at the end of the period has been sold. This method disregards

problems such as theft or breakage because the Merchandise Inventory account contains no up-to-date balance at

the end of the accounting period against which to compare the physical count.

Under periodic inventory procedure, a merchandising company uses the Purchases account to record the cost

of merchandise bought for resale during the current accounting period. The Purchases account, which is increased

by debits, appears with the income statement accounts in the chart of accounts.

To illustrate entries affecting the Purchases account, assume that Hanlon Retail Food Store made two purchases

of merchandise from Smith Wholesale Company. Hanlon purchased USD 30,000 of merchandise on credit (on

account) on May 4, and on May 21 purchased USD 20,000 of merchandise for cash. The required journal entries for

Hanlon are:

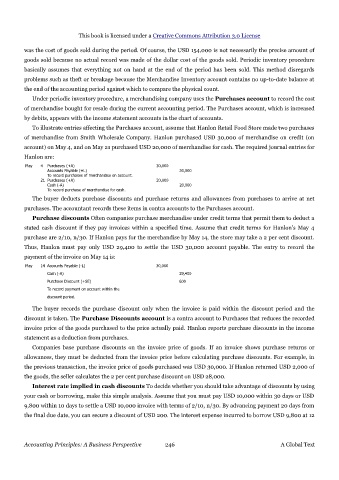

May 4 Purchases (+A) 30,000

Accounts Payable (+L) 30,000

To record purchases of merchandise on account.

21 Purchases (+A) 20,000

Cash (-A) 20,000

To record purchase of merchandise for cash.

The buyer deducts purchase discounts and purchase returns and allowances from purchases to arrive at net

purchases. The accountant records these items in contra accounts to the Purchases account.

Purchase discounts Often companies purchase merchandise under credit terms that permit them to deduct a

stated cash discount if they pay invoices within a specified time. Assume that credit terms for Hanlon's May 4

purchase are 2/10, n/30. If Hanlon pays for the merchandise by May 14, the store may take a 2 per cent discount.

Thus, Hanlon must pay only USD 29,400 to settle the USD 30,000 account payable. The entry to record the

payment of the invoice on May 14 is:

May 14 Accounts Payable (-L) 30,000

Cash (-A) 29,400

Purchase Discount (+SE) 600

To record payment on account within the

discount period.

The buyer records the purchase discount only when the invoice is paid within the discount period and the

discount is taken. The Purchase Discounts account is a contra account to Purchases that reduces the recorded

invoice price of the goods purchased to the price actually paid. Hanlon reports purchase discounts in the income

statement as a deduction from purchases.

Companies base purchase discounts on the invoice price of goods. If an invoice shows purchase returns or

allowances, they must be deducted from the invoice price before calculating purchase discounts. For example, in

the previous transaction, the invoice price of goods purchased was USD 30,000. If Hanlon returned USD 2,000 of

the goods, the seller calculates the 2 per cent purchase discount on USD 28,000.

Interest rate implied in cash discounts To decide whether you should take advantage of discounts by using

your cash or borrowing, make this simple analysis. Assume that you must pay USD 10,000 within 30 days or USD

9,800 within 10 days to settle a USD 10,000 invoice with terms of 2/10, n/30. By advancing payment 20 days from

the final due date, you can secure a discount of USD 200. The interest expense incurred to borrow USD 9,800 at 12

Accounting Principles: A Business Perspective 246 A Global Text