Page 60 - Accounting Principles (A Business Perspective)

P. 60

1. Accounting and its use in business decisions

1 The company paid rent for the premises for October, USD 19,200.

7 The company received cash of USD 4,200 for parking by daily customers during the week.

10 The company collected USD 14,400 of the accounts receivable in the balance sheet at September 30.

14 Cash receipts for the week from daily customers were USD 6,600.

15 Parking revenue earned but not yet collected from fleet customers was USD 6,000.

16 The company paid salaries of USD 2,400 for the period October 1–15.

19 The company paid advertising expenses of USD 1,200 for October.

21 Cash receipts for the week from daily customers were USD 7,200.

24 The company incurred miscellaneous expenses of USD 840. Payment will be due November 10.

31 Cash receipts for the last 10 days of the month from daily customers were USD 8,400.

31 The company paid salaries of USD 3,000 for the period October 16–31.

31 Billings to monthly customers totaled USD 21,600 for October.

31 Paid cash dividends of USD 24,000.

a. Prepare a summary of transactions (see Part A of Exhibit 4) using column headings as given in the preceding

balance sheet. Determine balances after each transaction.

b. Prepare an income statement for October 2010.

c. Prepare a statement of retained earnings for October 2010.

d. Prepare a balance sheet as of 2010 October 31.

Alternate problem E The following balance sheets for 2010 June 30, and 2010 May 31, and the income

statement for June are for Beach Camping Trailer Storage, Inc. (Common practice is to show the most recent period

first.)

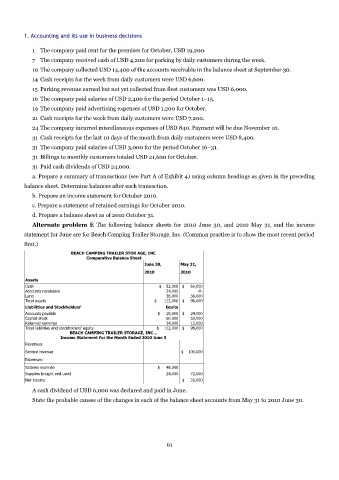

BEACH CAMPING TRAILER STOR AGE, INC

Comparative Balance Sheet

June 30, May 31,

2010 2010

Assets

Cash $ 52,000 $ 60,000

Accounts receivable 24,000 -0-

Land 36,000 36,000

Total assets $ 112,000 $ 96,000

Liabilities and Stockholders' Equity

Accounts payable $ 18,000 $ 24,000

Capital stock 60,000 60,000

Retained earnings 34,000 12,000

Total liabilities and stockholders' equity $ 112,000 $ 96,000

BEACH CAMPING TRAILER STORAGE, INC. ,

Income Statement For the Month Ended 2010 June 3

Revenues:

Service revenue $ 100,000

Expenses:

Salaries expense $ 48,000

Supplies bought and used 24,000 72,000

Net income $ 28,000

A cash dividend of USD 6,000 was declared and paid in June.

State the probable causes of the changes in each of the balance sheet accounts from May 31 to 2010 June 30.

61