Page 652 - Accounting Principles (A Business Perspective)

P. 652

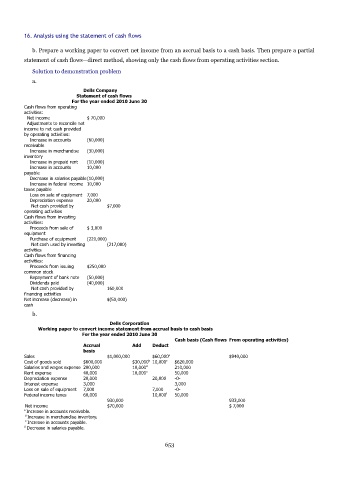

16. Analysis using the statement of cash flows

b. Prepare a working paper to convert net income from an accrual basis to a cash basis. Then prepare a partial

statement of cash flows—direct method, showing only the cash flows from operating activities section.

Solution to demonstration problem

a.

Dells Company

Statement of cash flows

For the year ended 2010 June 30

Cash flows from operating

activities:

Net income $ 70,000

Adjustments to reconcile net

income to net cash provided

by operating activities:

Increase in accounts (60,000)

receivable

Increase in merchandise (30,000)

inventory

Increase in prepaid rent (10,000)

Increase in accounts 10,000

payable

Decrease in salaries payable(10,000)

Increase in federal income 10,000

taxes payable

Loss on sale of equipment 7,000

Depreciation expense 20,000

Net cash provided by $7,000

operating activities

Cash flows from investing

activities:

Proceeds from sale of $ 3,000

equipment

Purchase of equipment (220,000)

Net cash used by investing (217,000)

activities

Cash flows from financing

activities:

Proceeds from issuing $250,000

common stock

Repayment of bank note (50,000)

Dividends paid (40,000)

Net cash provided by 160,000

financing activities

Net increase (decrease) in $(50,000)

cash

b.

Dells Corporation

Working paper to convert income statement from accrual basis to cash basis

For the year ended 2010 June 30

Cash basis (Cash flows From operating activities)

Accrual Add Deduct

basis

Sales $1,000,000 $60,000 a $940,000

Cost of goods sold $600,000 $30,000 10,000 c $620,000

b

Salaries and wages expense 200,000 10,000 d 210,000

Rent expense 40,000 10,000 e 50,000

Depreciation expense 20,000 20,000 -0-

Interest expense 3,000 3,000

Loss on sale of equipment 7,000 7,000 -0-

Federal income taxes 60,000 10,000 f 50,000

930,000 933,000

Net income $70,000 $ 7,000

a Increase in accounts receivable.

B Increase in merchandise inventory.

C Increase in accounts payable.

D Decrease in salaries payable.

653