Page 16 - latest pb aia 30 - Copy

P. 16

INTERNAL COMPARISON OF AIA INSURANCE COMPANY (2016,2017,2018)

PROFITABILITY RATIO

1. Return on Asset

Return on Asset

2%

2% 1.86%

1.80%

2%

1.60%

1%

2018 2017 2016

2018 2017 2016

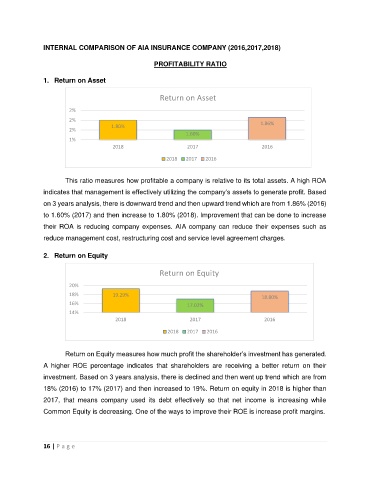

This ratio measures how profitable a company is relative to its total assets. A high ROA

indicates that management is effectively utilizing the company’s assets to generate profit. Based

on 3 years analysis, there is downward trend and then upward trend which are from 1.86% (2016)

to 1.60% (2017) and then increase to 1.80% (2018). Improvement that can be done to increase

their ROA is reducing company expenses. AIA company can reduce their expenses such as

reduce management cost, restructuring cost and service level agreement charges.

2. Return on Equity

Return on Equity

20%

18% 19.29% 18.80%

16% 17.02%

14%

2018 2017 2016

2018 2017 2016

Return on Equity measures how much profit the shareholder’s investment has generated.

A higher ROE percentage indicates that shareholders are receiving a better return on their

investment. Based on 3 years analysis, there is declined and then went up trend which are from

18% (2016) to 17% (2017) and then increased to 19%. Return on equity in 2018 is higher than

2017, that means company used its debt effectively so that net income is increasing while

Common Equity is decreasing. One of the ways to improve their ROE is increase profit margins.

16 | P a g e