Page 9 - MI New Hire webinar

P. 9

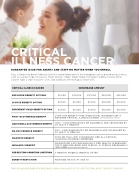

GUARANTEE ISSUE FOR AGENTS AND STAFF NO MATTER WHEN YOU ENROLL

Pays a lump-sum benefit directly to the insured following the initial diagnosis of a covered critical illness, such as: Cancer Type 1(invasive), Heart Attack, Stroke, Major Organ Transplant, Kidney Failure-100%, Cancer Type 2 (non-invasive)- 25%, and Coronary Artery Bypass Graft-25%

EMPLOYEE BENEFIT OPTIONS SPOUSE BENEFIT OPTION DEPENDENT CHILD BENEFIT OPTION FIRST OCCURRENCE BENEFIT ADDITIONAL OCCURRENCE BENEFIT RE-OCCURRENCE BENEFIT MAXIMUM BENEFIT

WELLNESS BENEFIT

PRE-EXISTING CONDITION LIMITATION BENEFIT REDUCTION

CRITICAL ILLNESS/CANCER

$5,000

$2,500

$10,000

$5,000

CONVERAGE AMOUNT

$15,000

$7,500

$20,000

$10,000

$25,000

$12,500

$2,500

$5,000

$7,500

LUMP SUM BENEFIT PAID UPON INITIAL DIAGNOSIS OF A COVERED CRITICAL ILLNESS/CANCER (AFTER WAITING PERIOD)

100% - PAID WHEN DATES OF DIAGNOSIS ARE SEPARATED BY AT LEAST 3 MONTHS

50% - PAID WHEN DATES OF DIAGNOSIS ARE SEPARATED BY AT LEAST 12 MONTHS

300% OF THE LUMP SUM BENEFIT FOR ALL CRITICAL ILLNESSES/CANCERS COMBINED

MAXIMUM OF $50 PAID ANNUALLY FOR HEALTH SCREENINGS TESTS FOR EMPLOYEE AND SPOUSE- IF SPOUSE COVERAGE IS INCLUDED (AFTER WAITING PERIOD)

$10,000

$12,500

3 MONTHS PRIOR/12 MONTHS AFTER

REDUCED TO 50% AT AGE 70

SPOUSE AND DEPENDENT COVERAGE IS ONLY AVAILABLE AT 50% OF THE EMPLOYEE’S BENEFIT AMOUNT

CRITICAL ILLNESS CANCER