Page 7 - Should you be claiming R&D tax credits

P. 7

WHAT ARE R&D TAX CREDITS?

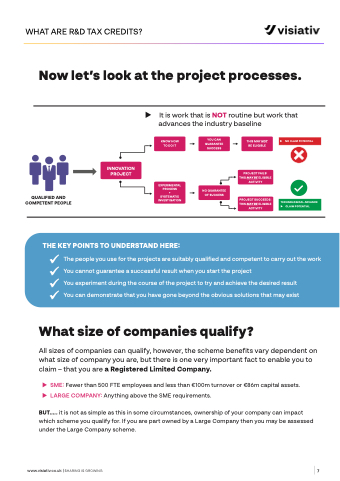

Now let’s look at the project processes.

WHAT ARE ‘ELIGIBLE’ R&D ACTIVITIES?

It is work that is NOT routine but work that advances the industry baseline

KNOW HOW TO DO IT

EXPERIMENTAL PROCESS

+ SYSTEMATIC INVESTIGATION

YOU CAN GUARANTEE SUCCESS

NO GUARANTEE OF SUCCESS

THIS MAY NOT BE ELIGIBLE

PROJECT FAILS: THIS MAY BE ELIGIBLE ACTIVITY

PROJECT SUCCEEDS: THIS MAY BE ELIGIBLE ACTIVITY

NO CLAIM POTENTIAL

INNOVATION PROJECT

QUALIFIED AND COMPETENT PEOPLE

TECHNOLOGICAL ADVANCE CLAIM POTENTIAL

THE KEY POINTS TO UNDERSTAND HERE:

9 The people you use for the projects are suitably qualified and competent to carry out the work 9 You cannot guarantee a successful result when you start the project

9 You experiment during the course of the project to try and achieve the desired result

9 You can demonstrate that you have gone beyond the obvious solutions that may exist

What size of companies qualify?

All sizes of companies can qualify, however, the scheme benefits vary dependent on what size of company you are, but there is one very important fact to enable you to claim – that you are a Registered Limited Company.

X SME: Fewer than 500 FTE employees and less than €100m turnover or €86m capital assets. X LARGE COMPANY: Anything above the SME requirements.

BUT..... it is not as simple as this in some circumstances, ownership of your company can impact which scheme you qualify for. If you are part owned by a Large Company then you may be assessed under the Large Company scheme.

www.visiativ.co.uk | SHARING IS GROWING 7