Page 8 - Should you be claiming R&D tax credits

P. 8

WHAT ARE R&D TAX CREDITS?

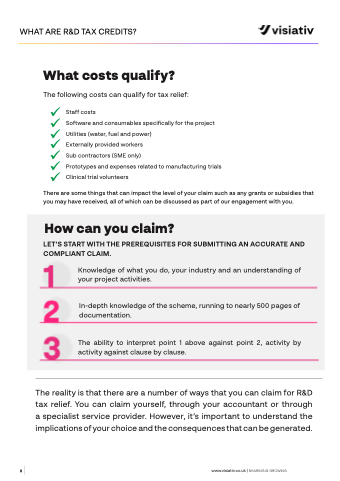

What costs qualify?

The following costs can qualify for tax relief:

9 Staff costs

9 Software and consumables specifically for the project 9 Utilities (water, fuel and power)

9 Externally provided workers

9 Sub contractors (SME only)

9 Prototypes and expenses related to manufacturing trials 9 Clinical trial volunteers

There are some things that can impact the level of your claim such as any grants or subsidies that you may have received, all of which can be discussed as part of our engagement with you.

How can you claim?

LET’S START WITH THE PREREQUISITES FOR SUBMITTING AN ACCURATE AND COMPLIANT CLAIM.

Knowledge of what you do, your industry and an understanding of your project activities.

In-depth knowledge of the scheme, running to nearly 500 pages of documentation.

The ability to interpret point 1 above against point 2, activity by activity against clause by clause.

8

www.visiativ.co.uk | SHARING IS GROWING

The reality is that there are a number of ways that you can claim for R&D tax relief. You can claim yourself, through your accountant or through a specialist service provider. However, it’s important to understand the implications of your choice and the consequences that can be generated.