Page 25 - JouleCasePPM.pdf_Neat

P. 25

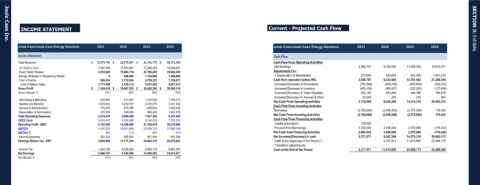

INCOME STATEMENT Current - Projected Cash Flow SECTION 3:

Projected Return and Capital Gains Schedule Exhibits

Joule Case Inc.

Joule Case/Joule Case Energy Solutions 2021 2022 2023 2024 Joule Case/Joule Case Energy Solutions 2021 2022 2023 2024

Income Statement Cash Flow

Total Revenue $ 12,079,780 $ 28,576,607 $ 42,192,779 $ 56,372,409 Cash Flow From Operating Activities

JCI Battery Sales 7,547,160 11,872,437 17,262,524 19,334,027 Net Earnings 2,566,707 9,190,560 13,938,262 19,615,471

Event Trailer Revene 4,532,620 15,864,170 23,796,255 35,694,383 Adjustments For:

Energy Arbitrage for Remaining Weeks 0 840,000 1,134,000 1,344,000 + Depreciation & Amortization 270,000 243,000 843,300 1,641,078

Cost of Events 906,524 3,172,834 4,759,251 7,138,877 Cash from operation before W/C 2,836,707 9,433,560 14,781,562 21,256,549

Cost of Battery Sales 3,773,580 5,936,219 8,631,262 9,667,013 (Increase)/Decrease in Receivables (765,588) (408,793) (559,569) (582,724)

Gross Profit $ 7,399,676 $ 19,467,555 $ 28,802,266 $ 39,566,519 (Increase)/Decrease in Inventory (465,236) (266,627) (332,265) (127,696)

Gross Margin % 61% 68% 68% 70% Increase/(Decrease) in Trade Payables 552,163 483,944 484,388 355,879

Increase/(Decrease) in Accrued & Other 20,000 200 202 204

Advertising & Marketing 550,964 914,591 1,333,028 1,538,574 Net Cash From Operating activities 2,178,046 9,242,284 14,374,318 20,902,212

Salaries and Benefits 1,678,052 3,032,507 3,576,010 4,637,352 Cash Flow From Investing Activities

General & Administration 775,453 879,388 1,285,054 1,530,425

Depreciation & Amortization 270,000 243,000 843,300 1,641,078 Borrowing (2,700,000) (3,546,000) (2,575,080) 176,422

Total Operating Expenses 3,274,470 5,069,486 7,037,392 9,347,430 Net Cash From Investing Activities (2,700,000) (3,546,000) (2,575,080) 176,422

OPEX Cash 3,004,470 4,826,486 6,194,092 7,706,352 Cash Flow From Financing Activities

Operating Profit - EBIT 4,125,206 14,398,068 21,764,874 30,219,090 Capital subscription 193,525 - - -

EBITDA 4,395,206 14,641,068 22,608,174 31,860,168 Proceed from Borrowings 2,700,000 3,546,000 2,575,080 (176,422)

EBITDA % 36% 51% 54% 57% Net Cash from Financing Activities 2,893,525 3,546,000 2,575,080 (176,422)

Interest Expenses 294,300 680,814 961,498 942,268 Net Increase/(Decrease) in cash 2,371,571 9,242,284 14,374,318 20,902,212

Earnings Before Tax - EBT 3,830,906 13,717,254 20,803,376 29,276,822 Cash at the beginning of the Period (*) - 2,371,571 11,613,855 25,988,173

Translation adjustmeents -

Income Tax 1,264,199 4,526,694 6,865,114 9,661,351 Cash at the End of the Period 2,371,571 11,613,855 25,988,173 46,890,385

Net Earnings 2,566,707 9,190,560 13,938,262 19,615,471

Net Margin % 57% 58% 59% 55%