Page 52 - Ready Set Retire

P. 52

Stephen J. Kelley

in the market and wish to receive income from it, at the start

of your retirement you should limit your income to no more

than 4% per year plus a small inflation adjustment each year.

That’s handy, because it provides a really nifty test for how

much a permanent annuity or payment pension is worth in

invested dollars. For example, assume you have a $20,000

pension, and your company is offering a $250,000 buyout.

Sounds pretty good, huh? Should you take it?

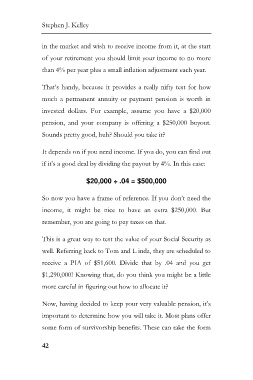

It depends on if you need income. If you do, you can find out

if it’s a good deal by dividing the payout by 4%. In this case:

$20,000 ÷ .04 = $500,000

So now you have a frame of reference. If you don’t need the

income, it might be nice to have an extra $250,000. But

remember, you are going to pay taxes on that.

This is a great way to test the value of your Social Security as

well. Referring back to Tom and L inda, they are scheduled to

receive a PIA of $51,600. Divide that by .04 and you get

$1,290,000! Knowing that, do you think you might be a little

more careful in figuring out how to allocate it?

Now, having decided to keep your very valuable pension, it’s

important to determine how you will take it. Most plans offer

some form of survivorship benefits. These can take the form

42