Page 29 - Know-So Money, Hope-So Money, Retirement Secrets Wall Street Doesn't Want You to Know

P. 29

This confluence of events has never happened in the history of the

Legal Reserve System.

I promised proof at the beginning of this section that the Legal Reserve

System had a better track record than the FDIC.

Legal Reserve companies had their strongest showing of strength

during the Great Depression of 1929-1938 when some 9,000 banks

suspended operations while 99% of all fixed life insurance in force

continued unaffected.

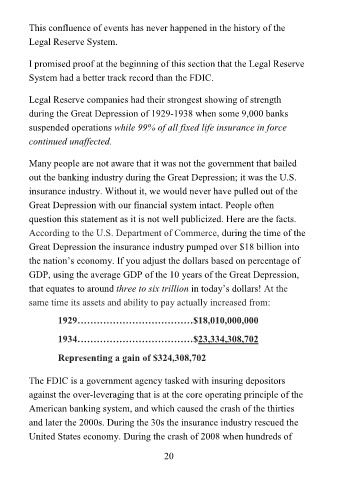

Many people are not aware that it was not the government that bailed

out the banking industry during the Great Depression; it was the U.S.

insurance industry. Without it, we would never have pulled out of the

Great Depression with our financial system intact. People often

question this statement as it is not well publicized. Here are the facts.

According to the U.S. Department of Commerce, during the time of the

Great Depression the insurance industry pumped over $18 billion into

the nation’s economy. If you adjust the dollars based on percentage of

GDP, using the average GDP of the 10 years of the Great Depression,

that equates to around three to six trillion in today’s dollars! At the

same time its assets and ability to pay actually increased from:

1929………………………………$18,010,000,000

1934………………………………$23,334,308,702

Representing a gain of $324,308,702

The FDIC is a government agency tasked with insuring depositors

against the over-leveraging that is at the core operating principle of the

American banking system, and which caused the crash of the thirties

and later the 2000s. During the 30s the insurance industry rescued the

United States economy. During the crash of 2008 when hundreds of

20