Page 43 - Know-So Money, Hope-So Money, Retirement Secrets Wall Street Doesn't Want You to Know

P. 43

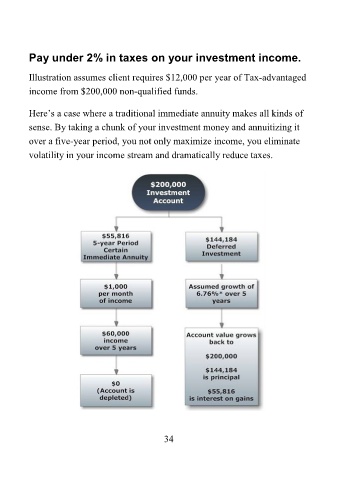

Pay under 2% in taxes on your investment income.

Illustration assumes client requires $12,000 per year of Tax-advantaged

income from $200,000 non-qualified funds.

Here’s a case where a traditional immediate annuity makes all kinds of

sense. By taking a chunk of your investment money and annuitizing it

over a five-year period, you not only maximize income, you eliminate

volatility in your income stream and dramatically reduce taxes.

34