Page 12 - 2020 Recaro North America Benefits Guide

P. 12

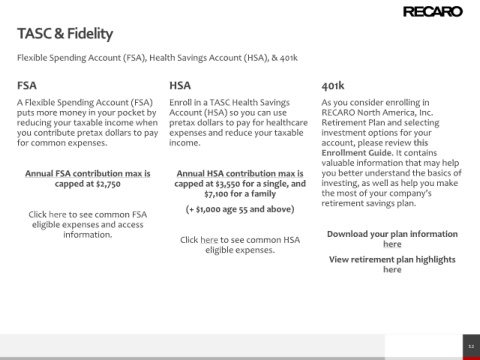

TASC & Fidelity

Flexible Spending Account (FSA), Health Savings Account (HSA), & 401k

FSA HSA 401k

A Flexible Spending Account (FSA) Enroll in a TASC Health Savings As you consider enrolling in

puts more money in your pocket by Account (HSA) so you can use RECARO North America, Inc.

reducing your taxable income when pretax dollars to pay for healthcare Retirement Plan and selecting

you contribute pretax dollars to pay expenses and reduce your taxable investment options for your

for common expenses. income. account, please review this

Enrollment Guide. It contains

valuable information that may help

Annual FSA contribution max is Annual HSA contribution max is you better understand the basics of

capped at $2,750 capped at $3,550 for a single, and investing, as well as help you make

$7,100 for a family the most of your company’s

retirement savings plan.

(+ $1,000 age 55 and above)

Click here to see common FSA

eligible expenses and access

information. Download your plan information

Click here to see common HSA here

eligible expenses.

View retirement plan highlights

here

12