Page 111 - 25148.pdf

P. 111

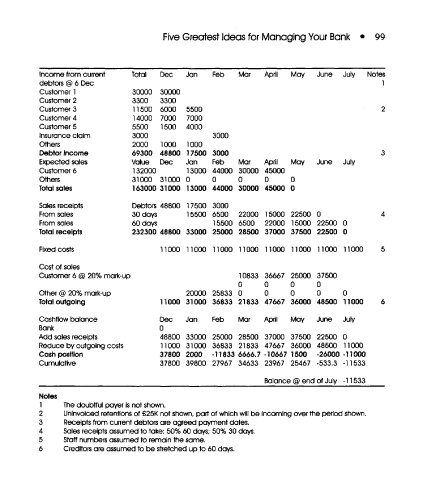

Five Greatest Ideas for Managing Your Bank • 99

Income from current Total Dec Jan Feb Mar April May June July Notes

debtors @ 6 Dec June July 1

Customer 1 30000 30000 5500 3000 2

Customer 2 3300 3300 7000

Customer 3 11500 6000 4000 3000 3

Customer 4 14000 7000 Feb

Customer 5 5500 1500 1000 44000 Mar April May

Insurance claim 3000 17500 0 30000 45000

Others 2000 1000 Jan 44000 0 0 0

Debtor income 69300 48800 13000 30000 45000 0

Expected sales Value Dec 0

Customer 6 132000 13000

Others 31000 31000

Total sales 163000 31000

Sales receipts Debtors 48800 17500 3000 22000 15000 22500 0 4

From sales 30 days 15500 6500 6500 22000 15000 22500

From sales 60 days 15500 28500 37000 37500 22500 0

Total receipts 232300 48800 33000 25000 0

Fixed costs 11000 11000 11000 11000 11000 11000 11000 11000

Cost of sales 10833 36667 25000 37500

Customer 6 @ 20% mark-up 0000

20000 25833 0 0 0 0 0

Other @ 20% mark-up 11000 31000 36833 21833 47667 36000 48500 11000

Total outgoing

Cashflow balance Dec Jan Feb Mar April May June July

Bank 0

Add sales receipts

Reduce by outgoing costs 48800 33000 25000 28500 37000 37500 22500 0

Cash position 11000 31000 36833 21833 47667 36000 48500 11000

Cumulative

37800 2000 -11833 6666.7 -10667 1500 -26000 -11000

37800 39800 27967 34633 23967 25467 -533.3 -11533

Balance @ endof July -11533

Notes The doubtful payer is not shown.

1 Uninvoiced retentions of £25K not shown, part of which will be incoming over the period shown.

2 Receipts from current debtors are agreed payment dates.

3 Sales receipts assumed to take: 50% 60 days; 50% 30 days.

4 Staff numbers assumed to remain the same.

5 Creditors are assumed to be stretched up to 60 days.

6