Page 131 - 25148.pdf

P. 131

Ten Greatest Ideas for Building the Retail Business of Your Dreams • 119

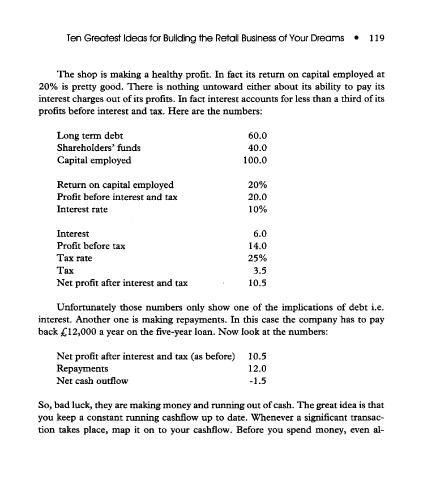

The shop is making a healthy profit. In fact its return on capital employed at

20% is pretty good. There is nothing untoward either about its ability to pay its

interest charges out of its profits. In fact interest accounts for less than a third of its

profits before interest and tax. Here are the numbers:

Long term debt 60.0

Shareholders' funds 40.0

Capital employed 100.0

Return on capital employed 20%

Profit before interest and tax 20.0

Interest rate 10%

Interest 6.0

Profit before tax 14.0

Tax rate 25%

Tax 3.5

Net profit after interest and tax 10.5

Unfortunately those numbers only show one of the implications of debt i.e.

interest. Another one is making repayments. In this case the company has to pay

back £12,000 a year on the five-year loan. Now look at the numbers:

Net profit after interest and tax (as before) 10.5

Repayments 12.0

Net cash outflow -1.5

So, bad luck, they are making money and running out of cash. The great idea is that

you keep a constant running cashflow up to date. Whenever a significant transac-

tion takes place, map it on to your cashflow. Before you spend money, even al-