Page 1 - How do I view the Mark to Markets Values

P. 1

Emory DM Derivative Value Page (MTM)

How do I view the Mark to Markets Values?

Overview

Mark-to-market (MTM), as defined, is a measure of the fair value of accounts that can change over time, such

as assets and liabilities. MTM aims to provide a realistic appraisal of an institution's current financial situation.

At Emory, the Interest Rate SWAP derivatives are mark-to-marketed on a monthly basis. The custom Emory

Derivatives Value page captures the MTM change for OBI Reporting.

Navigation

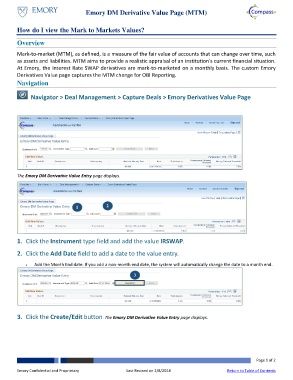

Navigator > Deal Management > Capture Deals > Emory Derivatives Value Page

The Emory DM Derivative Value Entry page displays.

1 2

1. Click the Instrument type field and add the value IRSWAP.

2. Click the Add Date field to add a date to the value entry.

Add the Month End date. If you add a non-month end date, the system will automatically change the date to a month end.

3

3. Click the Create/Edit button. The Emory DM Derivative Value Entry page displays.

Page 1 of 2

Emory Confidential and Proprietary Last Revised on 2/8/2018 Return to Table of Contents