Page 2 - Luminex 2019 Be Healthy 12pg with Notices v2_Neat

P. 2

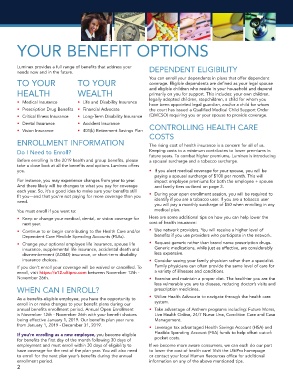

YOUR BENEFIT OPTIONS

Luminex provides a full range of benefits that address your DEPENDENT ELIGIBILITY

needs now and in the future.

You can enroll your dependents in plans that offer dependent

TO YOUR TO YOUR coverage. Eligible dependents are defined as your legal spouse

HEALTH WEALTH and eligible children who reside in your household and depend

primarily on you for support. This includes: your own children,

legally adopted children, stepchildren, a child for whom you

• Medical Insurance • Life and Disability Insurance

have been appointed legal guardian, and/or a child for whom

• Prescription Drug Benefits • Financial Advocate the court has issued a Qualified Medical Child Support Order

• Critical Illness Insurance • Long-Term Disability Insurance (QMCSO) requiring you or your spouse to provide coverage.

• Dental Insurance • Accident Insurance

• Vision Insurance • 401(k) Retirement Savings Plan CONTROLLING HEALTH CARE

COSTS

ENROLLMENT INFORMATION The rising cost of health insurance is a concern for all of us.

Do I Need to Enroll? Keeping costs to a minimum contributes to lower premiums in

future years. To combat higher premiums, Luminex is introducing

Before enrolling in the 2019 health and group benefits, please a spousal surcharge and a tobacco surcharge.

take a close look at all the benefits and options Luminex offers

you. • If you elect medical coverage for your spouse, you will be

paying a spousal surcharge of $100 per month. This will

For instance, you may experience changes from year to year. impact employee premiums for both the employee + spouse

And there likely will be changes to what you pay for coverage and family tiers outlined on page 3.

each year. So, it’s a good idea to make sure your benefits still

fit you—and that you’re not paying for more coverage than you • During your open enrollment session, you will be required to

need. identify if you are a tobacco user. If you are a tobacco user

you will pay a monthly surcharge of $50 when enrolling in any

You must enroll if you want to: medical plan.

• Keep or change your medical, dental, or vision coverage for Here are some additional tips on how you can help lower the

next year. cost of health insurance:

• Continue to or begin contributing to the Health Care and/or • Use network providers. You will receive a higher level of

Dependent Care Flexible Spending Accounts (FSAs). benefits if you use providers who participate in the network.

• Change your optional employee life insurance, spouse life • Request generic rather than brand name prescription drugs.

insurance, supplemental life insurance, accidental death and Generic medications, while just as effective, are considerably

dismemberment (AD&D) insurance, or short-term disability less expensive.

insurance choices. • Consider seeing your family physician rather than a specialist.

If you don’t enroll your coverage will be waived or cancelled. To Family physicians can often provide the same level of care for

enroll, visit https://e12.ultipro.com between November 12th - a variety of illnesses and conditions.

November 26th. • Exercise and maintain a proper diet. The healthier you are the

less vulnerable you are to disease, reducing doctor’s visits and

WHEN CAN I ENROLL? prescription medicines.

As a benefits-eligible employee, you have the opportunity to • Utilize Health Advocate to navigate through the health care

enroll in or make changes to your benefit plans during our system.

annual benefits enrollment period. Annual Open Enrollment • Take advantage of Anthem programs including: Future Moms,

is November 12th - November 26th with your benefit choices Live Health Online, 24/7 Nurse Line, Condition Care and Case

being effective January 1, 2019. Our benefits plan year runs Management.

from January 1, 2019 - December 31, 2019. • Leverage tax advantaged Health Savings Account (HSA) and

If you’re enrolling as a new employee, you become eligible Flexible Spending Account (FSA) funds to help offset out-of-

for benefits the first day of the month following 30 days of pocket costs.

employment and must enroll within 30 days of eligibility to If we become more aware consumers, we can each do our part

have coverage for the rest of the plan year. You will also need to lower the cost of health care! Visit the UltiPro homepage

to enroll for the next plan year’s benefits during the annual or contact your local Human Resources office for additional

enrollment period. information on any of the above mentioned tips.

2