Page 17 - FINAL 103018

P. 17

Banker-Appraiser Task Force Concerning Appraisal Issues Page 17.

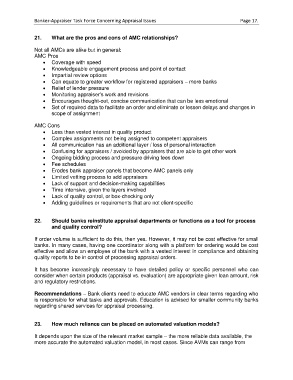

21. What are the pros and cons of AMC relationships?

Not all AMCs are alike but in general:

AMC Pros

• Coverage with speed

• Knowledgeable engagement process and point of contact

• Impartial review options

• Can equate to greater workflow for registered appraisers – more banks

• Relief of lender pressure

• Monitoring appraiser’s work and revisions

• Encourages thought-out, concise communication that can be less emotional

• Set of required data to facilitate an order and eliminate or lessen delays and changes in

scope of assignment

AMC Cons

• Less than vested interest in quality product

• Complex assignments not being assigned to competent appraisers

• All communication has an additional layer / loss of personal interaction

• Confusing for appraisers / avoided by appraisers that are able to get other work

• Ongoing bidding process and pressure driving fees down

• Fee schedules

• Erodes bank appraiser panels that become AMC panels only

• Limited vetting process to add appraisers

• Lack of support and decision-making capabilities

• Time intensive, given the layers involved

• Lack of quality control, or box-checking only

• Adding guidelines or requirements that are not client-specific

22. Should banks reinstitute appraisal departments or functions as a tool for process

and quality control?

If order volume is sufficient to do this, then yes. However, it may not be cost effective for small

banks. In many cases, having one coordinator along with a platform for ordering would be cost

effective and allow an employee of the bank with a vested interest in compliance and obtaining

quality reports to be in control of processing appraisal orders.

It has become increasingly necessary to have detailed policy or specific personnel who can

consider when certain products (appraisal vs. evaluation) are appropriate given loan amount, risk

and regulatory restrictions.

Recommendations – Bank clients need to educate AMC vendors in clear terms regarding who

is responsible for what tasks and approvals. Education is advised for smaller community banks

regarding shared services for appraisal processing.

23. How much reliance can be placed on automated valuation models?

It depends upon the size of the relevant market sample – the more reliable data available, the

more accurate the automated valuation model, in most cases. Since AVMs can range from