Page 4 - Jim VanArsdale

P. 4

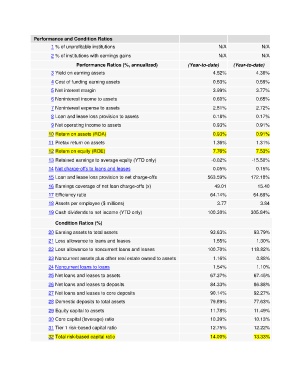

Performance and Condition Ratios

1 % of unprofitable institutions N/A N/A

2 % of institutions with earnings gains N/A N/A

Performance Ratios (%, annualized) (Year-to-date) (Year-to-date)

3 Yield on earning assets 4.52% 4.36%

4 Cost of funding earning assets 0.53% 0.59%

5 Net interest margin 3.99% 3.77%

6 Noninterest income to assets 0.60% 0.65%

7 Noninterest expense to assets 2.81% 2.72%

8 Loan and lease loss provision to assets 0.18% 0.17%

9 Net operating income to assets 0.93% 0.91%

10 Return on assets (ROA) 0.93% 0.91%

11 Pretax return on assets 1.36% 1.31%

12 Return on equity (ROE) 7.76% 7.53%

13 Retained earnings to average equity (YTD only) -0.02% -15.50%

0.05% 0.15%

14 Net charge-offs to loans and leases

15 Loan and lease loss provision to net charge-offs 563.59% 172.18%

16 Earnings coverage of net loan charge-offs (x) 49.01 15.40

17 Efficiency ratio 64.14% 64.69%

18 Assets per employee ($ millions) 3.77 3.84

19 Cash dividends to net income (YTD only) 100.30% 305.84%

Condition Ratios (%)

20 Earning assets to total assets 93.63% 93.79%

21 Loss allowance to loans and leases 1.55% 1.30%

22 Loss allowance to noncurrent loans and leases 100.70% 118.82%

23 Noncurrent assets plus other real estate owned to assets 1.16% 0.88%

1.54% 1.10%

24 Noncurrent loans to loans

25 Net loans and leases to assets 67.37% 67.45%

26 Net loans and leases to deposits 84.33% 86.88%

27 Net loans and leases to core deposits 90.14% 92.27%

28 Domestic deposits to total assets 79.89% 77.63%

29 Equity capital to assets 11.78% 11.49%

30 Core capital (leverage) ratio 10.39% 10.13%

31 Tier 1 risk-based capital ratio 12.75% 12.22%

32 Total risk-based capital ratio 14.00% 13.33%