Page 22 - UMB Membership Guide

P. 22

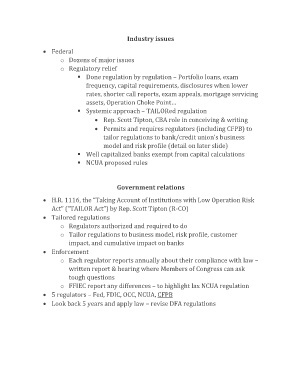

Industry issues

• Federal

o Dozens of major issues

o Regulatory relief

▪ Done regulation by regulation – Portfolio loans, exam

frequency, capital requirements, disclosures when lower

rates, shorter call reports, exam appeals, mortgage servicing

assets, Operation Choke Point…

▪ Systemic approach – TAILORed regulation

• Rep. Scott Tipton, CBA role in conceiving & writing

• Permits and requires regulators (including CFPB) to

tailor regulations to bank/credit union’s business

model and risk profile (detail on later slide)

▪ Well capitalized banks exempt from capital calculations

▪ NCUA proposed rules

Government relations

• H.R. 1116, the “Taking Account of Institutions with Low Operation Risk

Act” (“TAILOR Act”) by Rep. Scott Tipton (R-CO)

• Tailored regulations

o Regulators authorized and required to do

o Tailor regulations to business model, risk profile, customer

impact, and cumulative impact on banks

• Enforcement

o Each regulator reports annually about their compliance with law –

written report & hearing where Members of Congress can ask

tough questions

o FFIEC report any differences – to highlight lax NCUA regulation

• 5 regulators – Fed, FDIC, OCC, NCUA, CFPB

• Look back 5 years and apply law – revise DFA regulations