Page 3 - Mj banking conference brochure

P. 3

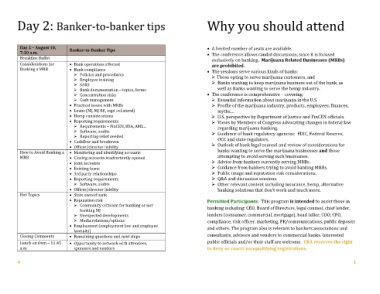

Day 2: Banker-to-banker tips Why you should attend

Day 2 – August 10, • A limited number of seats are available.

7:30 a.m. Banker-to-Banker Tips • The conference allows candid discussions, since it is focused

Breakfast Buffet exclusively on banking. Marijuana Related Businesses (MRBs)

Considerations for • Bank operations affected are prohibited.

Banking a MRB • Bank compliance • The sessions serve various kinds of banks:

➢ Policies and procedures

➢ Employee training ➢ Those opting to serve marijuana customers, and

➢ SARS ➢ Banks wanting to keep marijuana business out of the bank, as

➢ Bank documentation – topics, forms well as Banks wanting to serve the hemp industry.

➢ Concentration risks • The conference is comprehensive – covering:

➢ Cash management ➢ Essential information about marijuana in the U.S.

• Practical issues with MRBs ➢ Profile of the marijuana industry, products, employees, finances,

• Loans (MJ, MJ RE, eqpt collateral) myths…

• Hemp considerations ➢ U.S. perspective by Department of Justice and FinCEN officials.

• Reporting requirements ➢ Views by Members of Congress advocating changes in federal law

➢ Requirements – FinCEN, BSA, AML… regarding marijuana banking.

➢ Software, audits ➢ Guidance of bank regulatory agencies: FDIC, Federal Reserve,

➢ Reporting relief needed

• Cashflow and breakeven OCC and state regulators.

• Officer/director liability ➢ Outlook of bank legal counsel and review of considerations for

How to Avoid Banking a • Monitoring and identifying accounts banks wanting to serve the marijuana businesses and those

MRB • Closing accounts inadvertently opened attempting to avoid serving such businesses.

• Joint accounts ➢ Advice from bankers currently serving MRBs.

• Existing loans ➢ Guidance from bankers trying to avoid banking MRBs.

• 3rd party relationships ➢ Public image and reputation risk considerations.

• Reporting requirements ➢ Q&A and discussion sessions.

➢ Software, audits ➢ Other relevant content including insurance, hemp, alternative

• Officer/director liability banking solutions that don't work and much more.

Hot Topics • State owned bank

• Reputation risk Permitted Participants: This program is intended to assist those in

➢ Community criticism for banking or not banking including: CEO, Board of Directors, legal counsel, chief lender,

banking MJ

➢ Unexpected developments lenders (consumer, commercial, mortgage), head teller, COO, CFO,

➢ Media relations/options compliance, risk officer, marketing, PR/communications, public deposits

• Employment (employment law and employee and others. The program also is relevant to bankers associations and

lawsuits)

Closing Comments • Remaining questions and next steps consultants, advisors and vendors to commercial banks. Interested

Lunch on Own – 11:45 • Opportunity to network with attendees, public officials and/or their staff are welcome. CBA reserves the right

a.m. sponsors and vendors to deny or cancel nonqualifying registrations.

4 1

The program is intended for various positions in FDIC insured banks:

CEO, Board of Directors, legal counsel, chief lender, lenders (consumer,

commercial, mortgage), head teller, COO, CFO, compliance, risk officer,

marketing, PR/communications, public deposits and others. The

program also is relevant to bankers associations, public officials and