Page 5 - 2017 Spring Visit issue resources_Neat

P. 5

Spring Government Relations Summit Page 5.

Flood insurance. Help homeowners protect themselves by providing more incentives to participate in

the National Flood Insurance Program and encouraging development of a strong private flood

insurance market.

Rural growth. Pursue pro-growth policies to help farmers manage debt burdens and pricing

challenges, fight deposit flight through encouraging access to stable longer-term funding sources,

and address the shortage of qualified appraisers in rural areas that hinders real estate transactions.

Affordable housing. Expand the low-income housing tax credit, which currently funds 70 percent of

all affordable rental properties.

Remove Impediments to Serving Customers

Well-intentioned but overly prescriptive regulation and price controls, along with overzealous

enforcement, can be counter-productive and inhibit the ability of banks to offer products and services

that their customers want and need. Policies must strike the right balance between ensuring

fundamental standards are met while offering providers flexibility to meet the specific needs of their

clients, customers and communities.

Market pricing for card services. Restore market pricing on debit interchange fees so that consumers

can again enjoy more flexibility in the products and services that banks offer.

AML/BSA. Limit the burdens of BSA compliance and reporting—especially new requirements that

place undue burdens on customers themselves—and eliminate potential sanctions for banking legal

businesses.

Small-dollar credit. Promote banks’ ability to serve customers with small-dollar loans and overdraft

protection.

Sensible regulation. Oversee finance in a way that promotes growth and innovation, avoiding

arbitrary and capricious penalties and providing robust exam review and appeal channels. Update

rules to reflect changes in technology and eliminate the trickle down imposition of large bank

requirements placed on community banks.

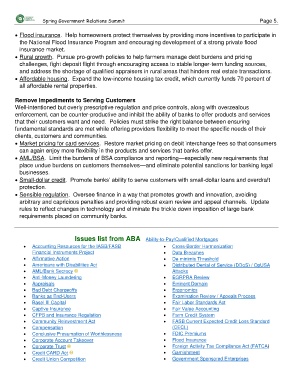

Issues list from ABA Ability-to-Pay/Qualified Mortgages

Accounting Resources for the IASB/FASB Cross-Border Harmonization

Financial Instruments Project Data Breaches

Affirmative Action De minimis Threshold

Americans with Disabilities Act Distributed Denial of Service (DDoS) / OpUSA

AML/Bank Secrecy Attacks

Anti-Money Laundering EGRPRA Review

Appraisals Eminent Domain

Bad Debt Chargeoffs Ergonomics

Banks as End-Users Examination Review / Appeals Process

Basel III Capital Fair Labor Standards Act

Captive Insurance Fair Value Accounting

CFPB and Insurance Regulation Farm Credit System

Community Reinvestment Act FASB Current Expected Credit Loss Standard

Compensation (CECL)

Conclusive Presumption of Worthlessness FDIC Premiums

Corporate Account Takeover Flood Insurance

Corporate Trust Foreign Activity Tax Compliance Act (FATCA)

Credit CARD Act Garnishment

Credit Union Competition Government Sponsored Enterprises