Page 42 - Cerini & Associates Family Office Guide

P. 42

SAFEGUARDING YOUR LEGACY - CONTINUED SAFEGUARDING YOUR LEGACY - CONTINUED

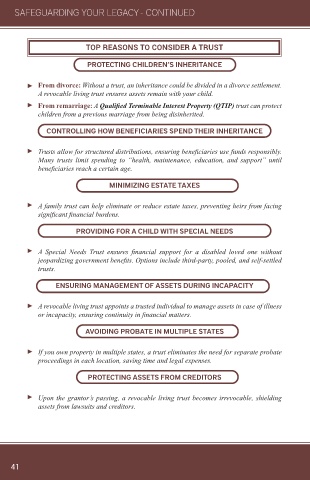

TOP REASONS TO CONSIDER A TRUST STEPS TO ESTABLISH A WILL AND TRUST

PROTECTING CHILDREN’S INHERITANCE Estate planning is not one-size-fits-all. Here’s how to prepare:

► From divorce: Without a trust, an inheritance could be divided in a divorce settlement. IDENTIFY YOUR GOALS

A revocable living trust ensures assets remain with your child.

► From remarriage: A Qualified Terminable Interest Property (QTIP) trust can protect ► Are you focused on asset protection, providing for loved ones, minimizing taxes, or all

children from a previous marriage from being disinherited. of the above?

CONTROLLING HOW BENEFICIARIES SPEND THEIR INHERITANCE TAKE INVENTORY OF YOUR ASSETS

► List real estate, investments, insurance policies, and other valuables that need to be

► Trusts allow for structured distributions, ensuring beneficiaries use funds responsibly.

Many trusts limit spending to “health, maintenance, education, and support” until included in your estate plan.

beneficiaries reach a certain age.

COMMUNICATE WITH LOVED ONES

MINIMIZING ESTATE TAXES

► Ensure family members understand your decisions regarding guardianship, trustees,

► A family trust can help eliminate or reduce estate taxes, preventing heirs from facing and the management of assets.

significant financial burdens.

Wills and trusts each play a crucial role in estate planning, but they serve different purposes.

PROVIDING FOR A CHILD WITH SPECIAL NEEDS While a will ensures your final wishes are honored, a trust provides greater control, privacy,

and protection for your assets. A combination of both may be the best approach to secure

your estate and your family’s future.

► A Special Needs Trust ensures financial support for a disabled loved one without

jeopardizing government benefits. Options include third-party, pooled, and self-settled

trusts.

ENSURING MANAGEMENT OF ASSETS DURING INCAPACITY

► A revocable living trust appoints a trusted individual to manage assets in case of illness

or incapacity, ensuring continuity in financial matters.

AVOIDING PROBATE IN MULTIPLE STATES

► If you own property in multiple states, a trust eliminates the need for separate probate

proceedings in each location, saving time and legal expenses.

PROTECTING ASSETS FROM CREDITORS

► Upon the grantor’s passing, a revocable living trust becomes irrevocable, shielding

assets from lawsuits and creditors.

41 42