Page 2 - ECIC 2020 Renewal

P. 2

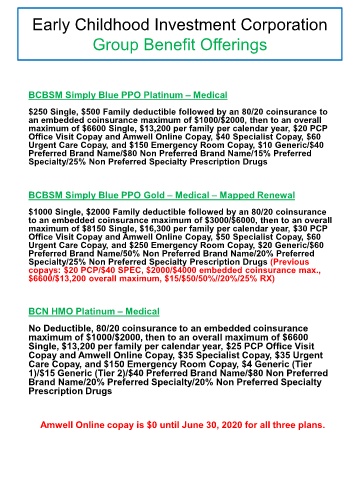

Early Childhood Investment Corporation

Group Benefit Offerings

BCBSM Simply Blue PPO Platinum – Medical

$250 Single, $500 Family deductible followed by an 80/20 coinsurance to

an embedded coinsurance maximum of $1000/$2000, then to an overall

maximum of $6600 Single, $13,200 per family per calendar year, $20 PCP

Office Visit Copay and Amwell Online Copay, $40 Specialist Copay, $60

Urgent Care Copay, and $150 Emergency Room Copay, $10 Generic/$40

Preferred Brand Name/$80 Non Preferred Brand Name/15% Preferred

Specialty/25% Non Preferred Specialty Prescription Drugs

BCBSM Simply Blue PPO Gold – Medical – Mapped Renewal

$1000 Single, $2000 Family deductible followed by an 80/20 coinsurance

to an embedded coinsurance maximum of $3000/$6000, then to an overall

maximum of $8150 Single, $16,300 per family per calendar year, $30 PCP

Office Visit Copay and Amwell Online Copay, $50 Specialist Copay, $60

Urgent Care Copay, and $250 Emergency Room Copay, $20 Generic/$60

Preferred Brand Name/50% Non Preferred Brand Name/20% Preferred

Specialty/25% Non Preferred Specialty Prescription Drugs (Previous

copays: $20 PCP/$40 SPEC, $2000/$4000 embedded coinsurance max.,

$6600/$13,200 overall maximum, $15/$50/50%//20%/25% RX)

BCN HMO Platinum – Medical

No Deductible, 80/20 coinsurance to an embedded coinsurance

maximum of $1000/$2000, then to an overall maximum of $6600

Single, $13,200 per family per calendar year, $25 PCP Office Visit

Copay and Amwell Online Copay, $35 Specialist Copay, $35 Urgent

Care Copay, and $150 Emergency Room Copay, $4 Generic (Tier

1)/$15 Generic (Tier 2)/$40 Preferred Brand Name/$80 Non Preferred

Brand Name/20% Preferred Specialty/20% Non Preferred Specialty

Prescription Drugs

Amwell Online copay is $0 until June 30, 2020 for all three plans.