Page 5 - Working With Real Estate Agents for Buyers,Buyers information Packet

P. 5

I

i

t

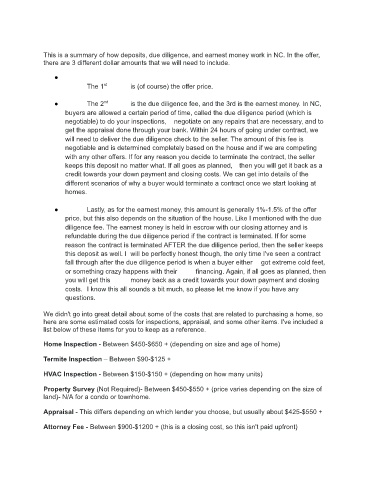

This s a summary of how deposits, due diligence, and earnest money work n NC. n he offer,

i

t

i

t

there are 3 different dollar amounts hat we will need o nclude.

●

The 1 is (of course) he offer price.

st

t

nd

t

● The 2 is he due diligence ee, and he 3rd s he earnest money. n NC,

I

t

t

f

i

t

buyers are allowed a certain period of ime, called he due diligence period (which s

t

i

t

t

i

negotiable) o do your nspections, negotiate on any repairs hat are necessary, and o

t

t

get he appraisal done hrough your bank. Within 24 hours of going under contract, we

t

t

will need o deliver he due diligence check o he seller. The amount of his ee s

i

f

t

t

t

t

i

t

negotiable and s determined completely based on he house and f we are competing

i

with any other offers. f or any reason you decide o erminate he contract, he seller

f

I

t

t

t

t

I

keeps his deposit no matter what. f all goes as planned, then you will get t back as a

t

i

i

t

t

credit owards your down payment and closing costs. We can get nto details of he

l

t

different scenarios of why a buyer would erminate a contract once we start ooking at

homes.

t

t

t

f

i

● Lastly, as or he earnest money, his amount s generally 1%-1.5% of he offer

I

t

t

t

t

price, but his also depends on he situation of he house. Like mentioned with he due

i

f

diligence ee. The earnest money s held n escrow with our closing attorney and s

i

i

t

i

t

i

f

refundable during he due diligence period f he contract s erminated. f or some

t

I

i

t

t

t

reason he contract s erminated AFTER he due diligence period, hen he seller keeps

t

t

I

this deposit as well. will be perfectly honest hough, he only ime 've seen a contract

t

I

t

t

f

t

fall hrough after he due diligence period s when a buyer either got extreme cold eet,

i

t

t

i

t

or something crazy happens with heir financing. Again, f all goes as planned, hen

t

you will get his money back as a credit owards your down payment and closing

t

i

costs. I know his all sounds a bit much, so please et me know f you have any

l

t

questions.

t

i

t

t

We didn't go nto great detail about some of he costs hat are related o purchasing a home, so

i

I

here are some estimated costs or nspections, appraisal, and some other tems. 've ncluded a

i

f

i

f

list below of hese tems or you o keep as a reference.

t

t

i

Home nspection - Between $450-$650 + (depending on size and age of home)

I

I

Termite nspection – Between $90-$125 +

I

HVAC nspection - Between $150-$150 + (depending on how many units)

Property Survey (Not Required)- Between $450-$550 + (price varies depending on he size of

t

t

f

land)- N/A or a condo or ownhome.

Appraisal - This differs depending on which ender you choose, but usually about $425-$550 +

l

i

i

t

Attorney Fee - Between $900-$1200 + (this s a closing cost, so his sn't paid upfront)