Page 19 - RosboroAR2020

P. 19

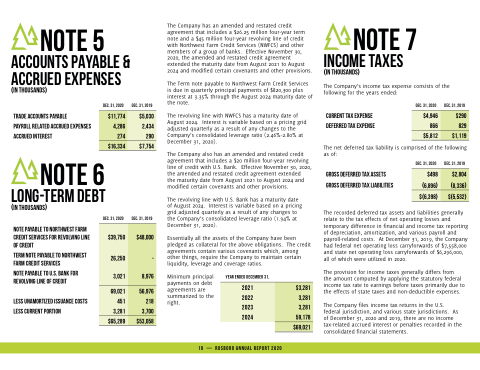

NOTE 5

ACCOUNTS PAYABLE &

ACCRUED EXPENSES (IN THOUSANDS)

DEC. 31, 2020

Trade accounts payable

Payroll related accrued expenses Accrued interest

NOTE 6 LONG-TERM DEBT

The Company has an amended and restated credit agreement that includes a $26.25 million four-year term note and a $45 million four-year revolving line of credit with Northwest Farm Credit Services (NWFCS) and other members of a group of banks. Effective November 30, 2020, the amended and restated credit agreement extended the maturity date from August 2021 to August 2024 and modi ed certain covenants and other provisions.

The Term note payable to Northwest Farm Credit Services is due in quarterly principal payments of $820,300 plus interest at 3.35% through the August 2024 maturity date of the note.

The revolving line with NWFCS has a maturity date of August 2024. Interest is variable based on a pricing grid adjusted quarterly as a result of any changes to the Company’s consolidated leverage ratio (2.46%-2.80% at December 31, 2020).

The Company also has an amended and restated credit agreement that includes a $20 million four-year revolving line of credit with U.S. Bank. Effective November 30, 2020, the amended and restated credit agreement extended

the maturity date from August 2021 to August 2024 and modi ed certain covenants and other provisions.

The revolving line with U.S. Bank has a maturity date of August 2024. Interest is variable based on a pricing grid adjusted quarterly as a result of any changes to the Company’s consolidated leverage ratio (1.94% at December 31, 2020).

Essentially all the assets of the Company have been pledged as collateral for the above obligations. The credit agreements contain various covenants which, among other things, require the Company to maintain certain liquidity, leverage and coverage ratios.

NOTE 7 INCOME TAXES

DEC. 31, 2020

DEC. 31, 2019

DEC. 31, 2019

following for the years ended:

Current tax expense Deferred tax expense

DEC. 31, 2020

DEC. 31, 2019

(IN THOUSANDS)

The Company’s income tax expense consists of the

$4,946

$290

866

829

$5,812

$1,119

$11,774

$5,030

4,286

2,434

274

290

$16,334

$7,754

The net deferred tax liability is comprised of the following as of:

DEC. 31, 2020

DEC. 31, 2019

$498

$2,804

(6,896)

(8,336)

$(6,398)

$(5,532)

(IN THOUSANDS)

The recorded deferred tax assets and liabilities generally relate to the tax effects of net operating losses and temporary difference in nancial and income tax reporting of depreciation, amortization, and various payroll and payroll-related costs. At December 31, 2019, the Company had federal net operating loss carryforwards of $7,558,000 and state net operating loss carryforwards of $6,296,000, all of which were utilized in 2020.

The provision for income taxes generally differs from

the amount computed by applying the statutory federal income tax rate to earnings before taxes primarily due to the effects of state taxes and non-deductible expenses.

The Company les income tax returns in the U.S. federal jurisdiction, and various state jurisdictions. As of December 31, 2020 and 2019, there are no income tax-related accrued interest or penalties recorded in the consolidated nancial statements.

Gross deferred tax assets Gross deferred tax liabilities

$39,750

$48,000

26,250

-

3,021

8,976

69,021

56,976

451

218

3,281

3,700

$65,289

$53,058

Note payable to Northwest Farm Credit Services for revolving line of credit

Term note payable to Northwest Farm Credit Services

Note payable to U.S. Bank for revolving line of credit

Less unamortized issuance costs Less current portion

Minimum principal payments on debt agreements are summarized to the right.

YEAR ENDED DECEMBER 31,

2021

2022

2023

2024

$3,281

3,281

3,281

59,178

$69,021

19 — ROSBORO ANNUAL REPORT 2020